Loading

Get Ca Ftb 540 Instructions 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540 Instructions online

This guide provides a comprehensive step-by-step process for filling out the CA FTB 540 Instructions online. It is designed to support users of all backgrounds, making the tax filing process clearer and more manageable.

Follow the steps to complete your CA FTB 540 Instructions online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Enter your social security number(s) or individual taxpayer identification number(s) at the top of Form 540, Side 1. Make sure to use black or blue ink if filling out a printed version.

- Print your name and address in the provided fields at the top of the form. Include your first name, middle initial, last name, and street address.

- For the suffix field, enter generational suffixes like 'SR', 'JR', 'III', or 'IV' as necessary.

- If applicable, provide your date of birth in the specified format (mm/dd/yyyy) in the spaces provided.

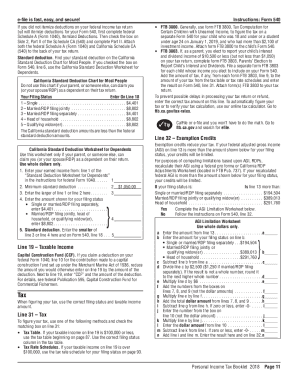

- Select your filing status by checking only one box from lines 1 through 5. Make sure to follow the same filing status as your federal return.

- Fill out the exemptions section to claim any personal or dependent exemptions. Ensure that all dependent’s details (name, SSN, relationship) are accurately entered.

- Calculate your taxable income by entering your income details from federal forms as instructed in the document.

- For any tax credits applicable, reference the additional credits section to find and claim the relevant credits. Ensure proper forms are attached if required.

- Double-check all entries for accuracy. Users can then save changes, download, print, or share the completed form.

Complete your CA FTB 540 Instructions online today to ensure timely and accurate filing.

Related links form

The best tax guide often depends on your personal situation, but the IRS Publication 17 is a solid resource for federal tax filing. Additionally, for residents filing California taxes, referring to the CA FTB 540 instructions ensures you understand state-specific requirements. Many tax software solutions also provide comprehensive guides that may fit your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.