Loading

Get Ny Dtf-950 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF-950 online

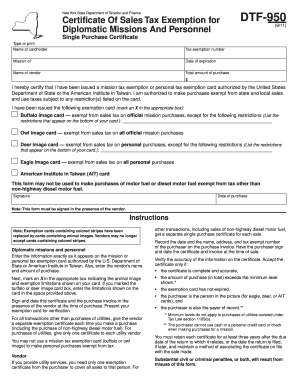

The NY DTF-950 form is a certificate for sales tax exemption specifically intended for diplomatic missions and their personnel. Filling it out online can streamline the process, ensuring that you accurately submit the necessary information for tax exemption.

Follow the steps to complete the NY DTF-950 online.

- Press the ‘Get Form’ button to obtain the NY DTF-950 form and open it in your preferred online editor.

- Fill in the name of the cardholder exactly as it appears on their tax exemption card. Ensure all details match to avoid any discrepancies.

- Enter the tax exemption number associated with the cardholder, which should also be found on the exemption card.

- Specify the mission of the cardholder accurately. This is important for identifying the issuing authority behind the exemption.

- Indicate the date of expiration for the exemption card. This ensures that the exemption is valid at the time of the purchase.

- Provide the name of the vendor from whom the purchase is being made. Accurate vendor identification is crucial for the exemption process.

- Detail the total amount of purchase in the designated area, ensuring the figure is accurate to facilitate efficient processing.

- Select the appropriate animal image card by marking an 'X' in the corresponding box. This indicates the type of exemption that is applicable.

- If the buffalo or deer image card is selected, list any relevant restrictions as indicated on the card itself in the space provided.

- Sign and date the form in the presence of the vendor at the time of the purchase. This is a requirement for the validity of the certificate.

- Once complete, save your changes to the document. You may also download, print, or share the completed NY DTF-950 form as needed.

Complete your documents online to ensure a seamless tax exemption process.

To cancel your NYS estimated tax payment, you must contact the New York State Department of Taxation and Finance directly. This process can vary depending on the timing and method of your original payment. Utilizing guidance related to the NY DTF-950 can simplify this task and help ensure you follow the correct procedures. Taking prompt action can avoid complications with your tax status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.