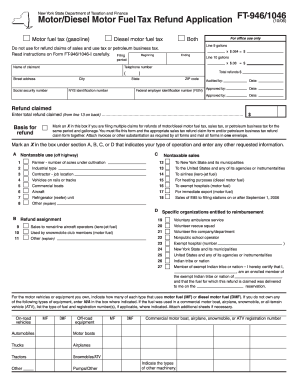

Get Ny Ft 946/1046 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY FT 946/1046 online

How to fill out and sign NY FT 946/1046 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans tend to favor completing their own tax returns and, in reality, to submit documents in digital format. The US Legal Forms web platform facilitates the task of e-filing the NY FT 946/1046 efficiently and effortlessly. Presently, it takes no longer than thirty minutes, and you can accomplish it from any place.

How you can complete NY FT 946/1046 quickly and effortlessly:

Ensure that you have accurately completed and dispatched the NY FT 946/1046 by the deadline. Review any relevant deadlines. If you provide incorrect information with your financial statements, it may result in serious penalties and complications with your yearly tax return. Utilize only professional templates from US Legal Forms!

Examine the PDF template in the editor.

Consult the highlighted fillable sections. This is where to input your information.

Select the option if you notice the checkboxes.

Move to the Text tool and other advanced functionalities to personally adjust the NY FT 946/1046.

Validate each piece of data before you continue signing.

Generate your personalized eSignature using a keypad, digital camera, touchpad, computer mouse, or smartphone.

Authorize your PDF document online and specify the date.

Click Done to proceed.

Download or forward the document to the recipient.

How to alter Get NY FT 946/1046 2006: personalize forms online

Explore a comprehensive service to manage all your documentation with ease. Locate, alter, and finalize your Get NY FT 946/1046 2006 within a unified platform using advanced tools.

The days when individuals had to print forms or even fill them out by hand are a thing of the past. Nowadays, all it takes to locate and complete any form, such as Get NY FT 946/1046 2006, is to open a single browser tab. Here, you will access the Get NY FT 946/1046 2006 form and adjust it in any manner you require, from inputting text directly into the document to sketching it on a digital sticky note and affixing it to the document. Uncover tools that will simplify your documentation processes without extra effort.

Just click the Get form button to easily prepare your Get NY FT 946/1046 2006 documentation and begin altering it right away. In the editing mode, you can effortlessly fill in the template with your information for submission. Just click on the field you need to modify and input the data immediately. The editor's interface is user-friendly and does not necessitate any specialized skills. Once you finish with the adjustments, verify the data's correctness once more and sign the document. Click on the signature field and follow the prompts to eSign the form in no time.

Utilize additional tools to tailor your form:

Completing Get NY FT 946/1046 2006 forms will never be confusing again if you know where to locate the appropriate template and process it effortlessly. Don't hesitate to give it a try.

- Employ Cross, Check, or Circle tools to highlight the document's information.

- Insert textual content or interactive text fields with text editing tools.

- Remove, Highlight, or Blackout text sections in the document using relevant tools.

- Include a date, initials, or even an image in the document as needed.

- Apply the Sticky note tool for comments on the form.

- Utilize the Arrow and Line, or Draw tool to incorporate visual elements into your document.

Filling out the NY ST 120 form requires careful attention to detail. Start by entering your business information, including name and address. Then, accurately list any exempt purchases and the reason for the exemption, ensuring you align your claims with the guidelines set forth in the NY FT 946/1046. For a helping hand, you can explore uslegalforms to find templates and detailed instructions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.