Loading

Get Ny Hb-01 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY HB-01 online

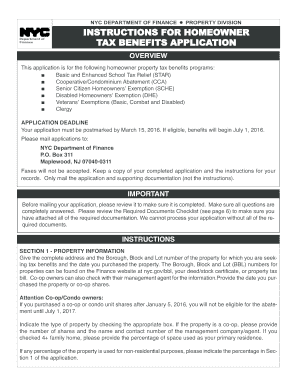

The NY HB-01 is essential for homeowners seeking property tax benefits in New York City. This guide provides clear, step-by-step instructions on filling out the form online, ensuring you understand each section and field to facilitate a smooth application process.

Follow the steps to successfully complete the NY HB-01 application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Section 1 by providing the complete address, Borough, Block, and Lot number of your property. Indicate the date of purchase and check the appropriate box for property type.

- Fill out Section 2 with the owner information for all individuals on the deed or stock certificate. Include names, dates of birth, and Social Security numbers.

- In Section 3, answer questions about any additional properties owned. If there are multiple properties, complete the Additional Property Information section as needed.

- Provide income information in Section 4 by attaching proof of income such as 2014 federal tax returns or other income documentation.

- Indicate occupancy details in Section 5, including information about children living in the property and any senior citizen or disabled rent exemptions.

- Complete Section 6 if you are applying for the Senior Citizen Homeowners Exemption, providing necessary identification.

- In Section 7, provide evidence of disability if applying for the Disabled Homeowners Exemption.

- Fill out Section 8 if any owners are veterans, checking the appropriate boxes and providing necessary documentation.

- Complete Section 9 for clergy information, specifying your role and any required documentation.

- Ensure all owners sign and date in Section 10, and provide a contact number and email address for follow-up.

- Review your application thoroughly, attach all required documents, and save the changes, download, or print the completed application.

Submit your NY HB-01 application online to streamline the process and ensure your eligibility for tax benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The New York State Senate currently has a smaller number of Republicans compared to Democrats. As of recent sessions, Republicans hold approximately 22 seats. This numerical disadvantage affects the approach to legislative matters such as NY HB-01, impacting how these discussions unfold.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.