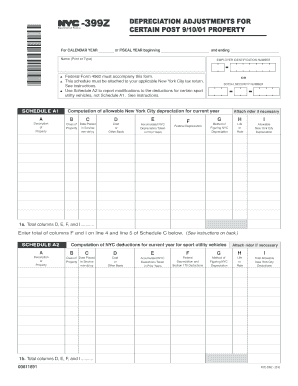

Get Ny Nyc-399z 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY NYC-399Z online

How to fill out and sign NY NYC-399Z online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans tend to favor preparing their own taxes and, furthermore, completing forms digitally.

The US Legal Forms online platform simplifies the task of submitting the NY NYC-399Z effortlessly.

Ensure that you have accurately filled out and submitted the NY NYC-399Z on time. Pay attention to any deadlines. Providing incorrect information in your tax documents can lead to significant penalties and complications with your annual tax return. Make sure to utilize only professional templates from US Legal Forms!

- Open the PDF template in the editor.

- Notice the highlighted fillable fields. Here you can enter your information.

- Select the option if you see checkboxes.

- Navigate to the Text icon along with other robust features to manually edit the NY NYC-399Z.

- Review all the information before proceeding to sign.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your document online and specify the exact date.

- Click on Done to continue.

- Store or forward the document to the intended recipient.

How to modify Get NY NYC-399Z 2016: personalize forms digitally

Put the suitable document management resources at your disposal. Complete Get NY NYC-399Z 2016 with our reliable service that integrates editing and eSignature features.

If you wish to finalize and authenticate Get NY NYC-399Z 2016 online without any hassle, then our cloud-based solution is the perfect choice. We provide an extensive template library of preformatted forms you can adjust and finish online. Moreover, there is no need to print out the document or utilize external applications to make it fillable. All necessary tools will be readily accessible once you launch the file in the editor.

Let’s explore our digital editing tools and their essential functions. The editor has a straightforward interface, so it won't require much time to figure out how to use it. We’ll inspect three main components that allow you to:

In addition to the functionalities listed above, you can safeguard your file with a password, insert a watermark, convert the file to the desired format, and much more.

Our editor simplifies the process of completing and certifying the Get NY NYC-399Z 2016. It allows you to manage nearly all aspects of working with forms. Additionally, we constantly ensure that your experience modifying documents is secure and adheres to major regulatory standards. All these elements make using our tool even more delightful.

Obtain Get NY NYC-399Z 2016, apply the necessary adjustments and modifications, and save it in the desired file format. Give it a try today!

- Modify and annotate the template

- The upper toolbar includes tools that assist you in emphasizing and obscuring text, excluding images and visual elements (lines, arrows, checkmarks, etc.), affix your signature to, initialize, date the document, and more.

- Arrange your documents

- Utilize the left toolbar if you want to rearrange the document and/or eliminate pages.

- Prepare them for distribution

- If you want to create the template fillable for others and distribute it, you can utilize the tools on the right to insert various fillable fields, signatures and dates, text boxes, etc.

The Internal Revenue Code (IRC) section for bonus depreciation is 168(k). This section outlines the rules governing the bonus depreciation deduction for property placed in service. Understanding this section is important for New York businesses operating under the NY NYC-399Z guidelines. To get clear insights and help with your tax preparation, consider using resources from US Legal Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.