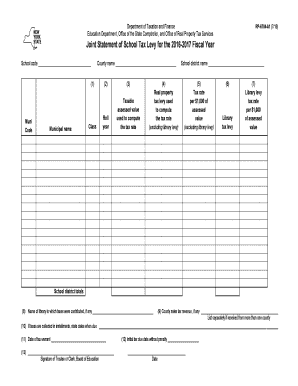

Get Ny Rp-6704-a1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY RP-6704-A1 online

How to fill out and sign NY RP-6704-A1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, the majority of Americans opt to handle their own income taxes and additionally complete reports digitally.

The US Legal Forms online service streamlines the process of e-filing the NY RP-6704-A1 quickly and effortlessly.

Ensure you have accurately filled out and submitted the NY RP-6704-A1 promptly. Be mindful of any deadlines. Providing incorrect information on your financial reports can lead to hefty fines and complications with your yearly tax filing. Always utilize verified templates from US Legal Forms!

- Access the PDF form in the editor.

- Refer to the designated fillable fields. Here you can input your details.

- Select an option when you encounter the checkboxes.

- Navigate to the Text icon along with other advanced tools to manually modify the NY RP-6704-A1.

- Review all the information prior to proceeding with the signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Validate your web-template online and indicate the date.

- Click on Done to proceed.

- Download or forward the document to the intended recipient.

How to Modify Get NY RP-6704-A1 2016: Personalize forms online

Locate the appropriate Get NY RP-6704-A1 2016 template and modify it immediately.

Streamline your documentation with an intelligent form editing solution for online paperwork.

Your daily processes with documentation and forms can be more productive when you have everything you require in one location. For example, you can find, obtain, and modify Get NY RP-6704-A1 2016 in a single browser window.

If you need a specific Get NY RP-6704-A1 2016, you can effortlessly locate it using the intelligent search engine and access it instantly. There is no need to download it or search for a third-party editor to amend it and input your information. All the necessary tools for effective work come in a singular comprehensive solution.

Make additional custom modifications with the available resources.

- This editing solution enables you to personalize, complete, and sign your Get NY RP-6704-A1 2016 form immediately.

- Upon finding a suitable template, click on it to enter the editing mode.

- After you access the form in the editor, all essential tools are right at your disposal.

- Filling in the designated fields is straightforward, and you can remove them if required using a simple yet versatile toolbar.

- Implement all changes immediately, and sign the form without exiting the tab by simply clicking the signature field.

Related links form

Typically, homeowners in New York do not stop paying school taxes until they sell their property or pass away. However, qualifying participants in programs such as Enhanced STAR can see a reduction in their payments. Ensuring you have filled out the NY RP-6704-A1 can provide the clarity and relief you need regarding school taxes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.