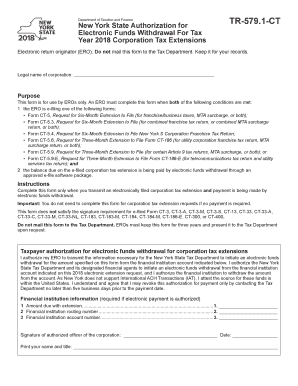

Get Ny Tr-579.1-ct 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY TR-579.1-CT online

How to fill out and sign NY TR-579.1-CT online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Currently, a majority of Americans generally favor handling their own tax returns and, indeed, completing forms digitally.

The US Legal Forms web service facilitates the process of submitting the NY TR-579.1-CT efficiently and conveniently.

Ensure that you have accurately completed and submitted the NY TR-579.1-CT on time. Consider any deadlines. Providing incorrect information on your financial statements can lead to serious penalties and cause issues with your annual tax filing. Always use professional templates from US Legal Forms!

- Launch the PDF template in the editor.

- Look at the highlighted fillable spaces. Here you can insert your details.

- Select the option if checkboxes are visible.

- Utilize the Text tool and other advanced features to manually adjust the NY TR-579.1-CT.

- Review each piece of information before proceeding to sign.

- Create your unique eSignature using a keypad, camera, touchpad, mouse, or smartphone.

- Authenticate your PDF document online and enter the date.

- Press Done to continue.

- Store or send the document to the intended recipient.

How to modify Get NY TR-579.1-CT 2018: tailor forms digitally

Disregard the conventional paper-driven method of completing Get NY TR-579.1-CT 2018. Finalize the form swiftly with our premier online editor.

Encountering difficulties in altering and finalizing Get NY TR-579.1-CT 2018? With a proficient editor like ours, you can conclude this in mere minutes without the necessity to print and scan documents repeatedly.

All files, by default, comprise editable fields you can fill in immediately upon accessing the template. However, if you wish to enhance the current content of the document or incorporate new information, you can select from a wide range of customization and annotation features. Emphasize, obscure, and annotate the document; include checkmarks, lines, text boxes, visuals, and notes. Furthermore, you can conveniently certify the template with a legally-binding signature. The finalized document can be shared with others, stored, dispatched to external programs, or converted into any other format.

You’ll never regret choosing our online tool to complete Get NY TR-579.1-CT 2018 as it is:

Don't squander time completing your Get NY TR-579.1-CT 2018 in outdated methods – with pen and paper. Opt for our feature-rich solution instead. It offers a versatile array of editing tools, integrated eSignature capabilities, and user-friendliness. What makes it exceptional is the collaborative team functionality – you can collaborate on documents with anyone, create a comprehensive document approval process from A to Z, and much more. Experiment with our online tool and secure the best value for your expenditure!

- Simple to establish and operate, even for those who haven’t filled documents electronically before.

- Sturdy enough to accommodate various editing requirements and form types.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible across different devices, making it hassle-free to complete the form from virtually anywhere.

- Able to generate forms based on pre-existing templates.

- Compatible with numerous file types: PDF, DOC, DOCX, PPT, and JPEG, etc.

Any corporation doing business in New York State must file a NY CT-3 return, regardless of whether it operates through a physical location. This includes corporations that are incorporated in New York or have jurisdictional presence within the state. Determining your obligation to file, especially in connection with NY TR-579.1-CT, is crucial for compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.