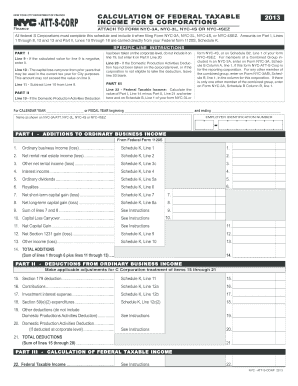

Get Nyc Dof Att-s-corp 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Taxable online

How to fill out and sign Applicable online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Today, most Americans would rather do their own income taxes and, furthermore, to complete forms in electronic format. The US Legal Forms online platform helps make the process of preparing the NYC DoF ATT-S-CORP simple and hassle-free. Now it takes no more than thirty minutes, and you can do it from any location.

How you can get NYC DoF ATT-S-CORP fast and easy:

-

Access the PDF sample in the editor.

-

See the highlighted fillable fields. This is where to insert your details.

-

Click on the variant to pick when you see the checkboxes.

-

Check out the Text tool and other advanced features to manually edit the NYC DoF ATT-S-CORP.

-

Verify every detail before you keep signing.

-

Design your exclusive eSignature by using a key-board, digital camera, touchpad, mouse or mobile phone.

-

Certify your web-template online and specify the particular date.

-

Click Done proceed.

-

Download or deliver the record to the receiver.

Ensure that you have completed and directed the NYC DoF ATT-S-CORP correctly by the due date. Think about any deadline. If you provide wrong data in your fiscal reports, it can lead to significant fines and create problems with your yearly tax return. Use only expert templates with US Legal Forms!

How to edit Deducted: customize forms online

Facilitate your document preparation process and adapt it to your needs within clicks. Complete and sign Deducted using a powerful yet easy-to-use online editor.

Managing documents is always difficult, particularly when you deal with it from time to time. It demands you strictly follow all the formalities and precisely complete all fields with full and precise information. However, it often happens that you need to adjust the form or insert extra fields to fill out. If you need to improve Deducted before submitting it, the simplest way to do it is by using our powerful yet simple-to-use online editing tools.

This comprehensive PDF editing solution allows you to quickly and easily fill out legal paperwork from any internet-connected device, make simple edits to the form, and add more fillable fields. The service allows you to opt for a specific area for each data type, like Name, Signature, Currency and SSN and so on. You can make them mandatory or conditional and choose who should fill out each field by assigning them to a defined recipient.

Make the steps below to optimize your Deducted online:

- Open required file from the catalog.

- Fill out the blanks with Text and drop Check and Cross tools to the tickboxes.

- Utilize the right-side toolbar to modify the template with new fillable areas.

- Choose the fields depending on the type of data you want to be collected.

- Make these fields mandatory, optional, and conditional and customize their order.

- Assign each area to a specific party with the Add Signer tool.

- Check if you’ve made all the required adjustments and click Done.

Our editor is a universal multi-featured online solution that can help you easily and quickly optimize Deducted along with other templates according to your needs. Optimize document preparation and submission time and make your forms look perfect without hassle.

When comparing costs between an S Corp and an LLC, it’s essential to consider various factors. Generally, forming an S Corp might involve higher initial fees and ongoing compliance costs due to stricter regulations. However, in terms of taxation, S Corps often offer potential savings on self-employment taxes. Therefore, the choice between the two should reflect your specific financial situation and goals related to the NYC DoF ATT-S-CORP.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.