Get Nyc Dof Att-s-corp 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Tm online

How to fill out and sign Expenditures online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

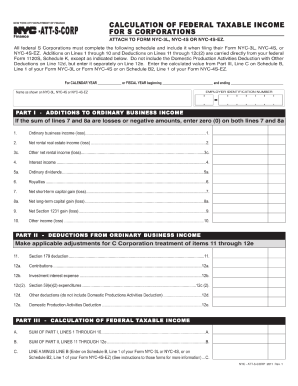

Today, most Americans would rather do their own income taxes and, in addition, to fill out reports digitally. The US Legal Forms browser service makes the procedure of e-filing the NYC DoF ATT-S-CORP easy and hassle-free. Now it requires no more than thirty minutes, and you can do it from any location.

How you can fill up NYC DoF ATT-S-CORP fast and easy:

-

Open the PDF sample in the editor.

-

See the highlighted fillable lines. This is where to put in your details.

-

Click on the option to select when you see the checkboxes.

-

Check out the Text tool along with other sophisticated functions to manually change the NYC DoF ATT-S-CORP.

-

Confirm every piece of information before you keep signing.

-

Make your distinctive eSignature using a keyboard, digital camera, touchpad, computer mouse or cellphone.

-

Certify your PDF form online and specify the particular date.

-

Click on Done proceed.

-

Download or send out the record to the recipient.

Make sure that you have completed and sent the NYC DoF ATT-S-CORP correctly in due time. Consider any deadline. If you provide incorrect data in your fiscal reports, it can lead to significant charges and create problems with your annual income tax return. Use only expert templates with US Legal Forms!

How to edit Deductions: customize forms online

Pick a reliable file editing solution you can rely on. Modify, complete, and sign Deductions securely online.

Very often, editing documents, like Deductions, can be pain, especially if you got them in a digital format but don’t have access to specialized software. Of course, you can use some workarounds to get around it, but you can end up getting a form that won't fulfill the submission requirements. Using a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We offer a smoother and more efficient way of completing files. A comprehensive catalog of document templates that are easy to change and certify, and then make fillable for some individuals. Our solution extends way beyond a collection of templates. One of the best aspects of using our option is that you can revise Deductions directly on our website.

Since it's a web-based solution, it spares you from having to get any application. Additionally, not all company policies allow you to install it on your corporate computer. Here's how you can effortlessly and securely complete your paperwork with our platform.

- Hit the Get Form > you’ll be instantly taken to our editor.

- Once opened, you can start the editing process.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Pick the date field to add a specific date to your template.

- Add text boxes, images and notes and more to enrich the content.

- Utilize the fillable fields option on the right to create fillable {fields.

- Choose Sign from the top toolbar to create and create your legally-binding signature.

- Hit DONE and save, print, and pass around or get the end {file.

Say goodbye to paper and other ineffective ways of completing your Deductions or other files. Use our solution instead that includes one of the richest libraries of ready-to-edit templates and a powerful file editing option. It's easy and secure, and can save you lots of time! Don’t take our word for it, try it out yourself!

The difference between an S Corp and an LLC in NY primarily lies in their taxation and ownership structure. An S Corp allows for pass-through taxation, while an LLC provides more operational flexibility and less formal structure. If you are exploring your options, the NYC DoF ATT-S-CORP can guide you in making an informed choice.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.