Get Oh Annual Update For Tax Practitioners 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH Annual Update For Tax Practitioners online

How to fill out and sign OH Annual Update For Tax Practitioners online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

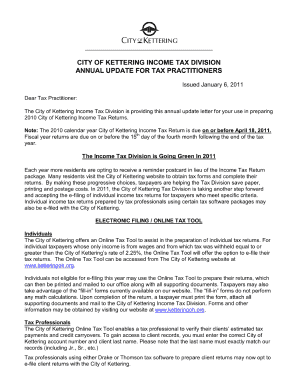

Currently, a majority of Americans seem to favor preparing their own income tax returns and, additionally, completing documents digitally.

The US Legal Forms online platform simplifies the process of e-filing the OH Annual Update For Tax Practitioners swiftly and conveniently.

Ensure that you have accurately completed and submitted the OH Annual Update For Tax Practitioners promptly. Keep in mind any relevant deadlines. Providing incorrect information in your financial statements may result in substantial penalties and complications with your annual tax return. Always utilize professional templates from US Legal Forms!

- Access the PDF form in the editor.

- Review the highlighted fillable sections where you can enter your details.

- Select the option you prefer when you see the checkboxes.

- Utilize the Text tool and other advanced options to manually adjust the OH Annual Update For Tax Practitioners.

- Examine every detail prior to signing.

- Create your unique electronic signature using a keyboard, camera, touchpad, mouse or smartphone.

- Authenticate your digital template and enter the date.

- Click on Done to proceed.

- Download or send the document to the recipient.

How to Modify Get OH Annual Update For Tax Practitioners 2011: Personalize forms online

Streamline your document preparation workflow and tailor it to your needs in just a few clicks. Complete and authorize Get OH Annual Update For Tax Practitioners 2011 using a robust yet user-friendly online editor.

Handling documents can be challenging, particularly when you are managing it intermittently. It requires strict compliance with all formal requirements and meticulous completion of all sections with accurate and detailed information. Nevertheless, it frequently happens that you need to adjust the form or add additional fields for completion. If you intend to refine Get OH Annual Update For Tax Practitioners 2011 prior to its submission, the easiest approach is to employ our powerful yet uncomplicated online editing tools.

This all-encompassing PDF editing application enables you to swiftly and effortlessly finalize legal documents from any device connected to the internet, perform simple modifications to the form, and incorporate extra fillable fields. The service lets you select a specific section for each type of data, such as Name, Signature, Currency, and SSN, among others. You can make these fields mandatory or conditional and determine who is responsible for completing each section by assigning it to a specific recipient.

Our editor is a versatile, feature-rich online solution that can assist you in swiftly and seamlessly tailoring Get OH Annual Update For Tax Practitioners 2011 along with other forms to meet your requirements. Reduce document preparation and submission duration while ensuring your paperwork appears professional without any fuss.

- Access the required file from the directory.

- Complete the fields with Text and place Check and Cross symbols in the checkboxes.

- Utilize the right-side toolbar to modify the template with new fillable sections.

- Select the fields based on the type of information you wish to gather.

- Designate these fields as mandatory, optional, or conditional and arrange their sequence.

- Assign each section to a specific participant using the Add Signer feature.

- Verify that you have made all necessary adjustments and click Done.

Tax preparers are required to follow IRS guidelines which include obtaining a PTIN, completing continuing education, and retaining proper records for all clients. Additionally, they must adhere to ethical standards and maintain client confidentiality. The OH Annual Update For Tax Practitioners offers comprehensive resources and updates to ensure compliance with these requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.