Loading

Get Oh Dte 100 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH DTE 100 online

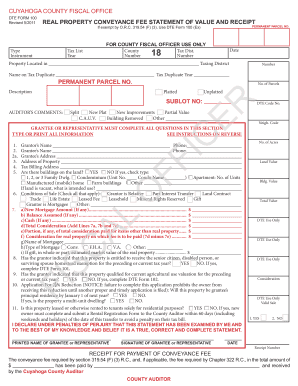

The OH DTE 100 is a vital form used for reporting the conveyance of real property in Cuyahoga County. This guide aims to simplify the process of filling out the form online, ensuring accuracy and compliance for all users.

Follow the steps to complete the OH DTE 100 form online.

- Click ‘Get Form’ button to access the DTE 100 document and open it in your browser.

- Provide the permanent parcel number in the designated field. This is essential for identifying the property involved in the transfer.

- Indicate the type of instrument being used for the conveyance by selecting the appropriate option from the provided dropdown or checkbox.

- Fill in the tax list year to ensure the record corresponds to the correct tax period.

- Enter the county and tax district number as required for internal processing.

- Complete the property location section, specifying the taxing district and name on the tax duplicate.

- In the grantee or representative section, type or print each piece of information clearly. Include names, phone numbers, and addresses as required.

- If there are buildings on the property, check 'YES' and indicate the type of buildings. If the land is vacant, detail the intended use.

- For conditions of sale, check all relevant boxes that apply to the transaction.

- Complete the financial sections. Include any mortgage amounts, cash, and total consideration as instructed.

- Declare under penalties of perjury by signing the form with your printed name.

- Finally, submit your form by saving changes, and choose to download, print, or share the completed document as needed.

Start filling out the OH DTE 100 online to facilitate your property conveyance process today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The property tax rate in Wood County, Ohio, varies depending on the municipality and type of property. Generally, homeowners can expect an average effective rate, but specifics can change annually. It’s wise to confirm the latest rates through official county resources and consider how the OH DTE 100 may relate to your property tax filings. Staying informed can help you plan your finances better.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.