Get Oh Dte 100ex 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH DTE 100EX online

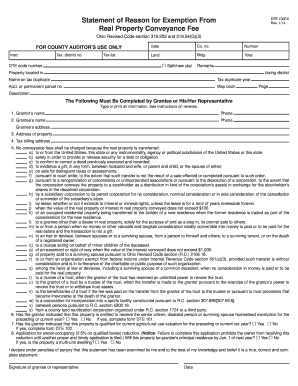

The OH DTE 100EX form is essential for requesting an exemption from the real property conveyance fee in Ohio. This guide provides clear steps for completing the form online, ensuring that users can easily navigate each section with confidence.

Follow the steps to effectively complete the OH DTE 100EX online.

- Press the ‘Get Form’ button to access the OH DTE 100EX form and open it in your editor.

- On the first section, enter the grantor’s name as it appears in the deed. Ensure that the name is spelled correctly for accurate processing.

- Next, fill in the grantee’s name along with their phone number. This is the individual or entity to whom the property is being transferred.

- Provide the grantee’s mailing address, as this is important for tax billing purposes.

- Input the property's address, including the street number and name, to specify the location of the real estate being conveyed.

- List the tax billing address to ensure that property taxes are sent to the correct location. Remember, property owners must pay taxes on time, regardless of receipt.

- In this section, select the applicable exemption by checking one of the boxes labeled (a) through (y). Review the exemption reasons carefully to choose the correct one.

- If applicable, answer whether the property is entitled to receive the senior citizen, disabled person, or surviving spouse homestead exemption. If yes, be ready to complete form DTE 101.

- Confirm if the property qualifies for current agricultural use valuation and be prepared to complete form DTE 102 if it does.

- For owner-occupancy reduction eligibility, indicate if the property will be their principal residence by January 1 of the following year. If yes, note whether it is a multi-unit dwelling.

- Finally, sign the form and date it to authenticate your submission. Ensuring all fields are completed accurately is critical for compliance with Ohio law.

- After completing the form, you can choose to save your changes, download a copy, print it, or share it as needed.

Complete your paperwork online today for a smoother filing experience.

Get form

To obtain a homestead exemption in Ohio, you need to be a homeowner who meets eligibility requirements, such as age or disability status. The application process involves completing necessary forms, including the OH DTE 100EX for documentation. This exemption can significantly lower your property tax burden, making it easier for you to keep your home. Consider checking with your local tax authority for specific instructions on completing the application.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.