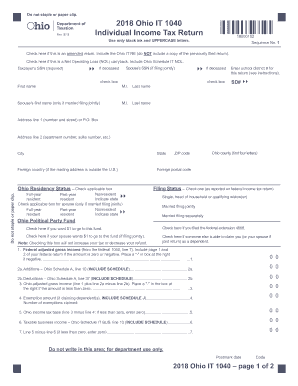

Get Oh It 1040 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH IT 1040 online

How to fill out and sign OH IT 1040 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, the majority of Americans choose to handle their own taxes and, additionally, to complete reports electronically.

The US Legal Forms online platform facilitates the task of preparing the OH IT 1040 swiftly and effortlessly.

Ensure you have accurately filled out and submitted the OH IT 1040 on time. Check for any relevant deadlines. Providing incorrect information on your financial documents may lead to severe penalties and complications with your annual tax filing. Utilize only professional templates from US Legal Forms!

- Access the PDF template in the editor.

- Refer to the highlighted fillable fields. This is where to enter your details.

- Select the choice when you encounter the checkboxes.

- Navigate to the Text icon and other advanced features to manually edit the OH IT 1040.

- Confirm all the details prior to proceeding to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your template online and specify the exact date.

- Click Done to proceed.

- Download or send the document to the recipient.

How to modify Get OH IT 1040 2018: personalize forms online

Select a trustworthy document editing solution you can depend on. Alter, finalize, and authenticate Get OH IT 1040 2018 securely online.

Frequently, modifying forms, such as Get OH IT 1040 2018, can be challenging, particularly if you received them digitally or through email but lack access to specialized software. While you may discover some alternatives to navigate this, you risk obtaining a document that fails to meet submission criteria. Utilizing a printer and scanner is not feasible either as it consumes time and resources.

We offer a more seamless and effective method of completing forms. A vast collection of document templates that are simple to modify and certify, and then make fillable for certain individuals. Our service goes far beyond a mere selection of templates. One of the greatest advantages of using our services is that you can alter Get OH IT 1040 2018 directly on our platform.

As it's a web-based solution, it spares you the need to install any software. Moreover, not all corporate regulations permit you to download it on your work laptop. Here's how you can easily and securely execute your documents with our solution.

Bid farewell to paper and other ineffective methods for altering your Get OH IT 1040 2018 or other documents. Opt for our solution instead, which features one of the most extensive collections of ready-to-edit templates and robust document editing services. It's straightforward and secure, and can save you a great deal of time! Don't just take our word for it, try it out for yourself!

- Click the Get Form > you’ll be instantly directed to our editor.

- Upon opening, you can begin the editing process.

- Choose checkmark, circle, line, arrow, cross and other options to annotate your document.

- Select the date field to insert a particular date into your template.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to create fillable {fields.

- Select Sign from the top menu to generate and create your legally-recognized signature.

- Click DONE and save, print, distribute, or obtain the final {file.

The $750 tax credit in Ohio, often referred to as the Ohio income tax credit, is designed to provide relief for taxpayers. This credit effectively reduces your tax liability dollar-for-dollar, making it an important feature of the Ohio IT 1040. Staying updated on eligibility requirements can help you benefit from this credit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.