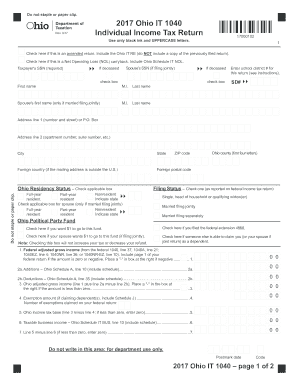

Get Oh It 1040 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH IT 1040 online

How to fill out and sign OH IT 1040 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, a majority of Americans tend to choose to handle their own tax returns and, in addition, to complete reports digitally.

The US Legal Forms web service makes the task of submitting the OH IT 1040 straightforward and convenient.

Ensure that you have filled out and submitted the OH IT 1040 accurately and on time. Consider any deadlines. If you submit incorrect information in your financial documents, it might lead to serious penalties and create issues with your annual tax return. Utilize only official templates from US Legal Forms!

- Open the PDF template in the editor.

- Observe the highlighted fillable sections. This is where you will enter your details.

- Select the option to indicate if you see the checkboxes.

- Advance to the Text tool and other advanced features to manually adjust the OH IT 1040.

- Verify all the details before you continue signing.

- Create your distinct eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Authenticate your document online and specify the exact date.

- Click on Done to proceed.

- Download or send the document to the recipient.

How to alter Get OH IT 1040 2017: tailor forms online

Your swiftly adjustable and customizable Get OH IT 1040 2017 template is easily accessible.

Do you delay finalizing Get OH IT 1040 2017 because you simply don’t know how to start and progress? We understand your concerns and have a fantastic tool for you that has nothing to do with combatting your procrastination!

Our online directory of ready-to-edit templates allows you to sort through and choose from thousands of printable forms designed for various use cases and scenarios. However, obtaining the document is only the first step. We provide you with all the essential tools to complete, sign, and modify the document of your choice without leaving our website.

All you have to do is open the document in the editor. Review the wording of Get OH IT 1040 2017 and confirm whether it aligns with what you’re looking for. Begin adjusting the template using the annotation tools to enhance the organization and presentation of your form.

In summary, along with Get OH IT 1040 2017, you will receive:

With our fully-equipped tool, your completed documents are always legally binding and thoroughly encrypted. We commit to protecting your most sensitive information and details.

Acquire what is necessary to generate a professional-looking Get OH IT 1040 2017. Make the right decision and try our platform now!

- Insert checkmarks, circles, arrows, and lines.

- Emphasize, obscure, and amend the existing text.

- If the document is meant for others as well, you can include fillable fields and share them for others to complete.

- Once you finish altering the template, you can obtain the file in any available format or select from various sharing or delivery options.

- A comprehensive suite of editing and annotation tools.

- A built-in legally binding eSignature capability.

- The ability to create documents from scratch or based on the pre-existing template.

- Compatibility with different platforms and devices for enhanced convenience.

- Multiple options for securing your documents.

- A variety of delivery options for smoother sharing and sending of documents.

- Adherence to eSignature laws governing the use of eSignature in online transactions.

Yes, you can file Ohio state taxes electronically. E-filing is a secure and efficient method, allowing you to file your OH IT 1040 quickly. Many online platforms, including US Legal Forms, offer user-friendly tools to facilitate the electronic submission of your state tax return. Utilizing these resources helps ensure that your filing is completed accurately and timely.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.