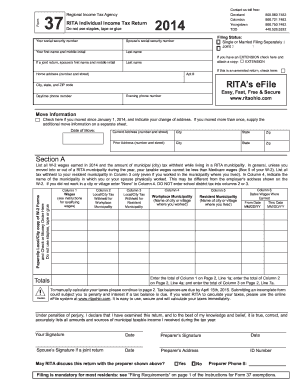

Get Oh Rita 37 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH RITA 37 online

How to fill out and sign OH RITA 37 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing a tax form can become a significant issue and a major headache if the right support is not available.

US Legal Forms was designed as an online resource for OH RITA 37 electronic filing and provides numerous advantages for taxpayers.

Press the Done button in the upper menu once you have finalized it. Save, download, or export the filled form. Use US Legal Forms to guarantee secure and straightforward filling of the OH RITA 37.

- Acquire the template from the designated area on the website or through the Search engine.

- Press the orange button to access it and wait for it to load.

- Examine the template and focus on the guidelines. If this is your first time filling out the form, adhere to the step-by-step instructions.

- Pay attention to the highlighted fields. These are editable and need specific information to be entered. If you are unsure what to input, refer to the instructions.

- Always ensure your signature is on the OH RITA 37. Use the integrated tool to create the e-signature.

- Click on the date section to automatically fill in the correct date.

- Review the form to verify and adjust it before submitting.

How to Modify Get OH RITA 37 2014: Personalize Forms Online

Bid farewell to a conventional paper-based method of processing Get OH RITA 37 2014. Get the form completed and authenticated in moments with our superior online editor.

Are you finding it difficult to alter and finalize Get OH RITA 37 2014? With a powerful editor like ours, you can accomplish this in just a few minutes without the hassle of printing and scanning documents back and forth. We provide fully adaptable and easy-to-use form templates that can serve as a foundation and assist you in finishing the required form online.

All templates, by default, come with editable fields that you can utilize as soon as you access the template. However, if you wish to enhance the current content of the document or add something new, you can choose from a variety of editing and annotation features. Emphasize, obscure, and annotate the text; insert checkmarks, lines, text boxes, images, notes, and comments. Additionally, you can swiftly validate the template with a legally-binding signature. The finalized document can be shared with others, saved, imported into external applications, or transformed into any common format.

You will certainly make the right choice by selecting our online tool to process Get OH RITA 37 2014 because it's:

Don't waste time completing your Get OH RITA 37 2014 in an outdated manner - using pen and paper. Utilize our comprehensive solution instead. It provides you with a versatile array of editing tools, integrated eSignature capabilities, and user-friendliness. What sets it apart from similar options is the team collaboration features - you can collaborate on forms with anyone, build a structured document approval process from scratch, and much more. Try our online solution and get exceptional value for your investment!

- Simple to install and operate, even for users who have never filled out documents electronically before.

- Powerful enough to accommodate various editing requirements and form types.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible across multiple operating systems, enabling you to complete the form from anywhere.

- Able to generate forms based on pre-drafted templates.

- Compatible with diverse document formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Related links form

Ignoring your obligations to OH RITA is not advisable and can lead to penalties and legal repercussions. Staying compliant with RITA requirements is critical for maintaining a good standing in your municipality. If you find filing challenging, using tools like US Legal Forms can help simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.