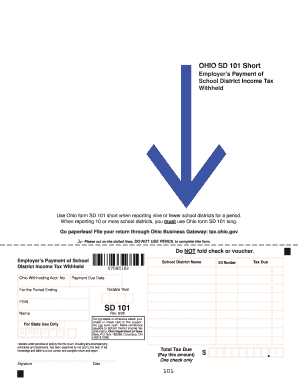

Get Oh Sd 101 Short 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OH SD 101 Short online

How to fill out and sign OH SD 101 Short online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing tax forms can become a significant hindrance and a major nuisance without adequate assistance provided.

US Legal Forms has been developed as an online alternative for OH SD 101 Short e-filing and offers many benefits for taxpayers.

Click the Done button on the top menu once you have completed it. Save, download, or export the filled-out template. Utilize US Legal Forms to ensure an easy and straightforward process for OH SD 101 Short completion.

- Locate the empty section on the site in the corresponding area or by using the search function.

- Click the orange button to access it and wait for it to load.

- Examine the template and follow the instructions. If you haven't filled out the sample before, comply with the step-by-step directions.

- Focus on the highlighted fields. They are editable and need specific information to be entered. If you're unsure what details to include, refer to the guidelines.

- Always sign the OH SD 101 Short. Utilize the in-built tool to create the electronic signature.

- Choose the date field to automatically insert the correct date.

- Review the template to verify and modify it before submission.

How to modify Get OH SD 101 Short 2008: personalize forms online

Select a dependable document editing option you can rely on. Revise, execute, and sign Get OH SD 101 Short 2008 safely online.

Frequently, altering documents, such as Get OH SD 101 Short 2008, can present difficulties, especially if received online or through email without access to specialized tools. While you might discover some alternative methods to circumvent this, the outcome could be a form that fails to comply with submission standards. Employing a printer and scanner isn’t feasible either, as it consumes time and resources.

We offer a simpler and more efficient method of adjusting files. An extensive array of document templates that are straightforward to personalize and validate, making them fillable for certain users. Our service goes far beyond just a selection of templates. One of the key benefits of using our platform is the ability to modify Get OH SD 101 Short 2008 directly on our site.

Put aside paper and other inefficient techniques for altering your Get OH SD 101 Short 2008 or additional forms. Utilize our solution instead that offers one of the most extensive libraries of readily-customizable templates and robust file editing services. It’s simple and secure, potentially saving you considerable time! Don’t just take our word for it, try it out for yourself!

- Hit the Get Form > you’ll be immediately directed to our editor.

- Once opened, you can commence the customization process.

- Select checkmark or circle, line, arrow and cross, along with other options to annotate your document.

- Choose the date field to add a specific date to your document.

- Insert text boxes, graphics and notes and more to enhance the content.

- Utilize the fillable fields option on the right to create fillable {fields.

- Select Sign from the top toolbar to generate and establish your legally-binding signature.

- Press DONE and save, print, and share or download the document.

Related links form

To acquire an Ohio employer withholding account number, you need to register with the Ohio Department of Taxation. You can complete this registration online or submit a paper application. Having this account number is vital for reporting employee tax withholdings accurately. The OH SD 101 Short provides useful information to help you navigate this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.