Loading

Get Oh Sd 141 Long 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH SD 141 Long online

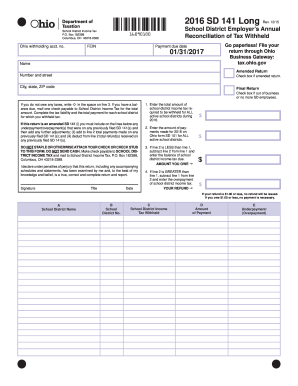

The OH SD 141 Long form is essential for school districts in Ohio to report income tax withheld from employees. This guide will help you navigate through each section of the form, ensuring that you provide accurate information.

Follow the steps to complete the OH SD 141 Long form online.

- Click ‘Get Form’ button to access the OH SD 141 Long form and open it in your chosen editor.

- Enter your Ohio withholding account number in the designated field at the top of the form.

- Provide your Federal Employer Identification Number (FEIN) to verify your business identity.

- Indicate the payment due date, which is typically January 31 of the following year.

- Fill in your name, street address, city, state, and ZIP code in the corresponding fields.

- If you are submitting an amended return, check the box indicating it is an amended return.

- If you are filing a final return because your business has ceased operations or you no longer have employees subject to the tax, check the box for final return.

- Report the total amount of school district income tax required to be withheld for all active school districts during the tax year on line 1.

- On line 2, enter the amount of payments made for the current year using Ohio form SD 101 for all active school districts.

- Calculate the balance due: If line 2 is less than line 1, subtract line 2 from line 1. Enter this amount on the line indicating the amount you owe.

- If line 2 is greater than line 1, subtract line 1 from line 2 and enter this amount on the corresponding refund line.

- Complete the section for individual school district reporting by filling out the school district name, number, income tax withheld, amount of payment, and any underpayment or overpayment for each applicable district.

- Sign and date the form, affirming that the information provided is complete and accurate.

- Finally, save your changes, and you can download, print, or share the completed form as needed.

Complete your OH SD 141 Long form online today to stay compliant with school district tax requirements.

The Ohio SD100 form must be filed by individuals who owe school district taxes, including those with taxable income sourced from Ohio. This form allows taxpayers to report their income and calculate the corresponding liability for local taxes. It is essential to file this form on time to avoid penalties. For an easy filing process, you can rely on uslegalforms to guide you through the necessary steps.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.