Loading

Get Ca Ftb 540nr Instructions 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540NR Instructions online

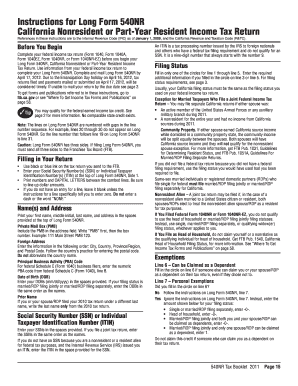

Filling out your California Nonresident or Part-Year Resident Income Tax Return (Long Form 540NR) can be straightforward. This guide provides clear, step-by-step instructions to help users effectively complete the form online.

Follow the steps to successfully complete your CA FTB 540NR Instructions.

- Press the ‘Get Form’ button to obtain the Long Form 540NR and open it in your editor.

- Fill in your Social Security Number or Individual Taxpayer Identification Number at the top of Side 1 of Long Form 540NR.

- Print your first name, middle initial, last name, and address in the designated spaces at the top of Long Form 540NR. For a Private Mail Box, include ‘PMB’ first followed by your box number.

- If applicable, provide your foreign address in the correct format: City, Country, Province/Region, and Postal Code.

- Enter your Date of Birth (mm/dd/yyyy) in the spaces provided. If filing jointly, ensure the sequence matches the names listed.

- Select your Filing Status by filling in only one of the circles for line 1 through line 5. Follow the additional instructions if certain statuses are selected.

- For Exemptions, complete lines 6 through 10 to claim any applicable personal, blind, senior, or dependent exemptions.

- Calculate your Total Taxable Income based on your federal income tax return and enter this on lines 12 through 17.

- Determine and enter California Itemized Deductions or Standard Deduction on line 18, choosing the greater amount.

- Complete any additional sections and calculations as outlined in the instructions, carefully following the guidance for tax computation and applicable credits.

- Once all fields are accurately filled, review your form, ensuring correctness, and proceed to save, download, print, or share your completed Long Form 540NR as necessary.

Complete your CA FTB 540NR Instructions online to ensure accurate and timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The CA 540NR is intended for non-residents and part-year residents of California. If you earned income from California sources or if you moved to or from California during the tax year, you need to file this form. The CA FTB 540NR Instructions will help you navigate the requirements, ensuring you meet your tax obligations correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.