Loading

Get Ok Bt-175 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK BT-175 online

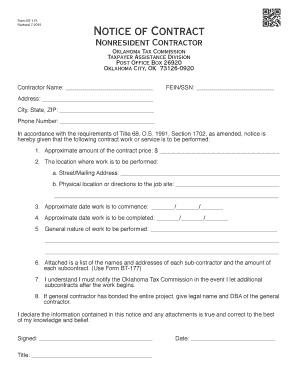

The OK BT-175 is a notice of contract form required by the Oklahoma Tax Commission for nonresident contractors. This guide will help you complete the form online with clear, step-by-step instructions for each required section.

Follow the steps to complete the OK BT-175 form online.

- Press the ‘Get Form’ button to access the OK BT-175 document. This will allow you to open the form in an editable format.

- In the first section labeled 'Contractor Name,' enter the full legal name of the contractor performing the work.

- For 'FEIN/SSN,' input the Federal Employer Identification Number or Social Security Number of the contractor.

- In the 'Address' field, provide the street address of the contractor, ensuring to include city, state, and ZIP code.

- Enter the phone number of the contractor in the designated area.

- In the section for 'Approximate amount of the contract price,' state the estimated total price for the contract.

- Specify the location where the work is to be performed by filling out both the street/mailing address and physical location or directions to the job site.

- Provide approximate dates for when the work is expected to commence and when it is anticipated to be completed.

- Describe the general nature of the work to be performed in the respective field.

- If applicable, attach a list of subcontractors and their corresponding amounts using Form BT-177.

- Acknowledge that you must notify the Oklahoma Tax Commission if additional subcontracts are let after the work begins.

- If a general contractor is bonded for the entire project, enter their legal name and doing business as (DBA) name in the provided fields.

- Finally, read the declaration statement carefully, then sign and date the form to confirm that the information provided is accurate.

Complete your OK BT-175 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Exemptions from Oklahoma state tax typically include low-income individuals, certain veterans, and active duty military personnel. Also, some retirement income may be exempt from state taxation. To identify if you qualify for any exemptions, check the guidelines on the OK BT-175. USLegalForms can assist you with detailed information and forms related to these exemptions, simplifying your tax filing experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.