Get Ok Otc 215 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

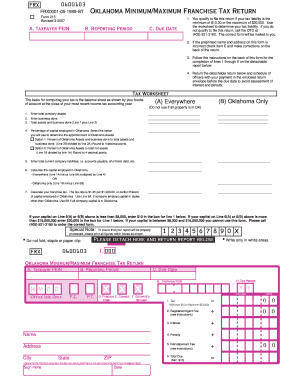

Tips on how to fill out, edit and sign OK OTC 215 online

How to fill out and sign OK OTC 215 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax documents can turn into a significant obstacle and substantial nuisance without adequate guidance provided.

US Legal Forms is created as an online solution for OK OTC 215 e-filing and offers various advantages for taxpayers.

Hit the Done button in the top menu once you have completed it. Save, download or export the finished form. Utilize US Legal Forms to ensure a smooth and straightforward completion of OK OTC 215.

- Get the template from the webpage in the specific section or through the search engine.

- Click the orange button to open it and wait until it’s fully loaded.

- Examine the blank form and pay attention to the instructions. If you have never filled out the form before, adhere to the step-by-step instructions.

- Focus on the highlighted fields. They are editable and require specific information to be filled in. If you are unclear about what information to enter, refer to the guidance.

- Always sign the OK OTC 215. Use the integrated tool to create your electronic signature.

- Click the date field to automatically insert the correct date.

- Review the form to verify and modify it before submitting.

How to modify Get OK OTC 215 2007: personalize forms online

Your swiftly adjustable and customizable Get OK OTC 215 2007 template is readily accessible. Leverage our library equipped with a built-in online editor.

Do you postpone finishing Get OK OTC 215 2007 because you simply don't know where to begin and how to proceed? We recognize your emotions and possess an excellent tool for you that is entirely unrelated to battling your procrastination!

Our online collection of ready-to-use templates permits you to browse and select from thousands of fillable forms designed for various applications and scenarios. However, acquiring the file is only the beginning. We offer you all the essential tools to fill out, certify, and alter the document of your choice without departing from our site.

All it takes is to launch the form in the editor. Review the wording of Get OK OTC 215 2007 and verify if it's what you’re seeking. Start off editing the document by utilizing the annotation tools to provide your form a more structured and tidier appearance.

In conclusion, alongside Get OK OTC 215 2007, you will receive:

Adherence to eSignature frameworks governing the use of eSignature in electronic transactions.

With our expert solution, your completed forms will always be officially binding and fully encrypted. We ensure the protection of your most sensitive information. Acquire everything necessary to create a professional-looking Get OK OTC 215 2007. Make the optimal choice and test our system now!

- Insert checkmarks, circles, arrows, and lines.

- Emphasize, obscure, and amend the existing text.

- If the document is meant for additional users as well, you can incorporate fillable fields and distribute them for other parties to complete.

- When you’re finished modifying the template, you can obtain the document in any available format or select any sharing or distribution options.

- A comprehensive suite of editing and annotation tools.

- A built-in legally-binding eSignature solution.

- The capability to create forms from scratch or based on the pre-drafted template.

- Compatibility with various platforms and devices for increased convenience.

- Multiple options for securing your files.

- A variety of delivery choices for easier sharing and sending out documents.

To request a refund for the Oklahoma franchise tax, you will need to complete a specific refund request form. Ensure you include all pertinent information and documentation with your request. The OK OTC 215 provides detailed instructions on this process. If you need help, uslegalforms can provide templates to streamline your request.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.