Loading

Get Ok Otc 215 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC 215 online

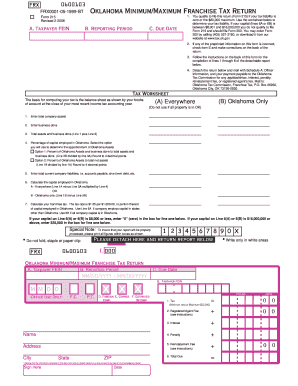

Filling out the OK OTC 215 form is essential for corporations in Oklahoma to report their minimum or maximum franchise tax. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the OK OTC 215 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your taxpayer FEIN in section A. This is a unique identification number assigned to your business.

- Specify the reporting period in section B. This is the time frame for which you are filing the return.

- Provide the due date in section C, which denotes when your return must be submitted.

- Review the qualifications to file this return. Ensure that your tax liability is zero or a maximum of $20,000, as indicated in the instructions.

- Check for any incorrect preprinted information in item E and make necessary corrections on the back of the return.

- Follow specific instructions on the back for completing lines 1 through 6 of the detachable report.

- Detach the return and ensure to include Schedule A: Officer Information, and any payment if applicable.

- Finalize the form by signing and dating it to declare the information is true and correct.

- Save changes, download, or print the completed form to ensure you have a record of your submission.

Complete your forms online to ensure timely and accurate submissions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Oklahoma state tax forms can be obtained from the Oklahoma Tax Commission's official website, where they offer a wide variety of forms for different tax purposes. You can also visit local tax offices for printed forms. US Legal Forms offers convenient access to many state-related documents, which can save you time and effort.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.