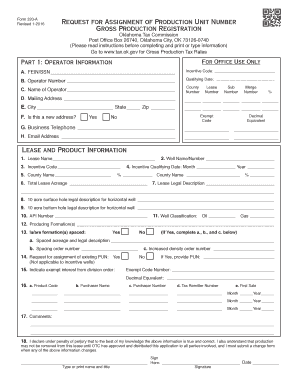

Get Ok Otc 320-a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OK OTC 320-A online

How to fill out and sign OK OTC 320-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax documents can become a significant ordeal and a major inconvenience if proper guidance is not offered.

US Legal Forms has been created as a digital solution for OK OTC 320-A e-filing and offers numerous benefits for taxpayers.

Click the Done button in the top menu when you're finished. Save, download, or export the completed template. Utilize US Legal Forms to ensure a secure and straightforward OK OTC 320-A completion.

- Access the blank form on the site within the relevant section or through the Search engine.

- Click the orange button to open it and wait for it to finish loading.

- Review the template and follow the directions. If you haven't filled out the sample before, adhere to the step-by-step instructions.

- Pay attention to the highlighted fields. These are fillable and require specific information to be entered. If you're uncertain about what to input, consult the instructions.

- Always sign the OK OTC 320-A. Use the built-in tool to create your electronic signature.

- Select the date field to automatically insert the appropriate date.

- Review the template to press and edit it before submitting.

How to modify Get OK OTC 320-A 2016: personalize forms via the internet

Completing documents is simpler with intelligent online tools. Eliminate paperwork with easily downloadable Get OK OTC 320-A 2016 templates that you can modify online and print.

Creating documents and paperwork should be more straightforward, whether it’s a routine aspect of one’s employment or a sporadic task. When one needs to submit a Get OK OTC 320-A 2016, understanding rules and guidelines on how to properly fill out a form and what it should contain can be time-consuming and demanding. However, if you discover the appropriate Get OK OTC 320-A 2016 template, completing a document will no longer be difficult with a smart editor available.

Explore a broader array of functionalities you can incorporate into your document workflow. There’s no requirement to print, fill out, and annotate forms manually. With a smart editing platform, all the necessary document processing features will always be easily accessible. If you aim to enhance your workflow with Get OK OTC 320-A 2016 forms, locate the template in the catalog, choose it, and uncover a simpler way to complete it.

You can also incorporate custom graphic elements into the form. Utilize the Arrow, Line, and Draw tools to modify the file. The more tools you are acquainted with, the more effortlessly you can work with Get OK OTC 320-A 2016. Experiment with the solution that offers everything required to locate and edit forms in one tab of your browser and bid farewell to manual paperwork.

- If you wish to add text in any section of the form or insert a text field, utilize the Text and Text field tools to extend the text in the form as extensively as desired.

- Employ the Highlight tool to emphasize the important portions of the form.

- If you need to obscure or eliminate certain text segments, apply the Blackout or Erase tools.

- Personalize the form by adding standard graphic elements. Utilize the Circle, Check, and Cross tools to integrate these components into the forms, as needed.

- For extra notes, make use of the Sticky note tool and add as many notes to the form page as necessary.

- If the form requires your initials or date, the editor provides tools for that as well. Minimize the likelihood of errors with the Initials and Date tools.

If you receive a letter from the Oklahoma Tax Commission, it may relate to your tax obligations, including owed amounts or required actions. It's important to read the letter carefully for specific guidance. The OK OTC 320-A can provide context and instructions for responding appropriately. Being proactive in addressing tax communication helps you maintain compliance and avoid complications.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.