Loading

Get Ok Otc 512e 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC 512E online

This guide provides comprehensive and user-friendly instructions for filling out the OK OTC 512E form online. Follow these steps to ensure accurate completion for your organization’s tax-exempt status.

Follow the steps to successfully complete the OK OTC 512E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

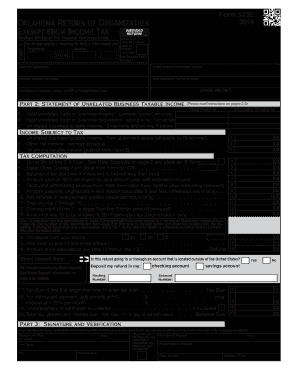

- Begin by indicating whether this is an amended return by placing an ‘X’ in the checkbox if applicable. Fill in the year for which you are filing and enter the dates for the beginning and ending taxable year.

- In the Name of Organization field, enter the legal name of your organization along with the Federal Employer Identification Number and complete your full address.

- In Part 2, provide a statement of unrelated business taxable income. Start by entering the total unrelated trade or business income, total deductions, and calculate the unrelated business taxable income.

- For Oklahoma taxable income, sum the unrelated business taxable income and any other net income. This total will determine the balance of tax due.

- Complete the tax computation section by calculating the tax at 6% and subtracting any applicable credits. Ensure all amounts are accurate to avoid underpayment.

- In the section for direct deposits, fill in whether your refund will go into a checking or savings account. Enter the necessary routing and account numbers, ensuring accuracy to avoid processing errors.

- Finally, in Part 3, provide your signature and the signature of an officer or trustee, including the date of signing. Attach any required documents such as schedules or federal returns as needed.

- Review all entries for accuracy before saving your changes. Once completed, you may download, print, or share the form as necessary.

Ensure your organization's tax-exempt status is filed correctly by completing your OK OTC 512E form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, the Oklahoma Tax Commission may settle for less than the total tax debt owed, depending on your financial circumstances. Utilizing the OK OTC 512E could assist you in navigating this settlement process. Always consult with a tax professional or a platform like uslegalforms to obtain the best strategies for negotiating your tax liabilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.