Loading

Get Ca Ftb 540nr Schedule Ca 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 540NR Schedule CA online

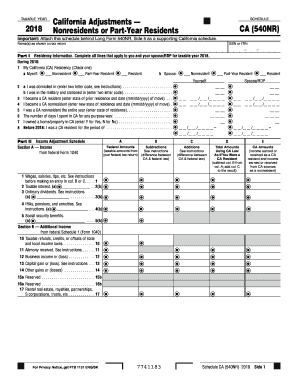

Filling out the CA FTB 540NR Schedule CA is essential for nonresidents or part-year residents filing their California taxes. This guide provides clear and comprehensive steps to assist users in completing the form accurately and confidently online.

Follow the steps to successfully complete your Schedule CA online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Begin with Part I, Residency Information. Fill in all lines that pertain to you and your spouse/registered domestic partner (RDP) for the taxable year 2018. Indicate your residency status by checking the appropriate box for yourself and your spouse/RDP.

- In Part I, provide the two-letter code for the state you were domiciled in and any relevant military details, including the state you were stationed in.

- Continue with all pertinent residency information, noting whether you owned property in California and the number of days spent in the state.

- Move to Part II, Income Adjustment Schedule, where you will report income from your federal Form 1040. Start by documenting business income or losses, capital gains or losses, and any other pertinent income details.

- Complete Section A by noting any subtractions and additions related to California and federal law differences, ensuring accurate calculation of total amounts per the instructions.

- Proceed to Section B for Additional Income, where similar information as in Section A will need to be provided, including taxable amounts and adjustments.

- In Part III, review and adjust your itemized deductions based on federal adjustments, checking the box if you did not itemize federally but will for California.

- Finalize your adjustments in Part IV by calculating your California taxable income. Complete all calculations accurately, as these will affect your tax return.

- Once you have filled out all sections, review the form for accuracy. You can then save changes, download, print, or share the completed Schedule CA online.

Start completing your CA FTB 540NR Schedule CA online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, non-resident aliens can file their taxes online, specifically using forms like CA FTB 540NR Schedule CA. Many online filing platforms cater to non-resident requirements, allowing for easy completion of your tax filing. Ensure you select software that accommodates non-resident filing rules to avoid complications. Utilizing appropriate resources can streamline this process for you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.