Get Ok Otc 900xm 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC 900XM online

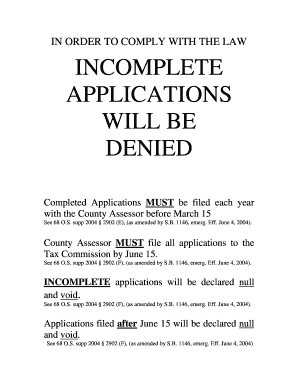

The OK OTC 900XM form is essential for applying for a five-year ad valorem tax exemption for manufacturing or research and development facilities in Oklahoma. This guide provides step-by-step instructions for filling out the form online, ensuring your application is complete and compliant with state regulations.

Follow the steps to fill out the OK OTC 900XM form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill in the year the company was established in Oklahoma and the application XM#. Ensure this information is accurate to avoid delays.

- Provide details regarding the operational year of the facility and the date filed. Identify the school district where the facility is located.

- Complete the applicant section with your name, mailing address, corporate contact name, and contact details for both the applicant and facility.

- Indicate the employee basic health insurance carrier and the policy number to demonstrate compliance with health insurance requirements.

- List the applicable NAICS codes and a description of the manufacturing activity. Be clear and precise in your descriptions.

- Answer the questions regarding the facility's classification as a research and development facility and other relevant inquiries, providing explanations where required.

- Detail the property owned at the facility, including its value and any leased property using the worksheet provided. Make sure to include all required documentation.

- Complete the affidavit section ensuring that it is properly signed and notarized, as this attests to the truth of the information provided.

- Once all sections are completed, review your application for completeness, and then you can save the changes, download, print, or share the form for submission.

Complete your OK OTC 900XM application online today to ensure compliance and take advantage of potential tax exemptions.

Get form

In Oklahoma, individuals are generally eligible for property tax exemptions when they reach the age of 65. This exemption can help reduce the financial burden on senior citizens, making it easier for them to manage their properties. Utilizing the OK OTC 900XM can help clarify eligibility requirements and application processes for seniors.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.