Loading

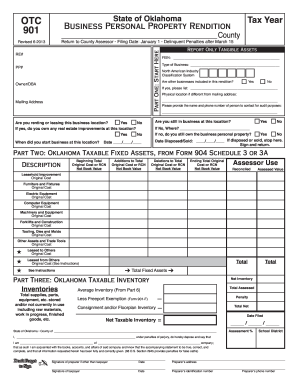

Get Ok Otc 901 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC 901 online

The OK OTC 901 form is essential for reporting business personal property in Oklahoma. This guide equips you with the necessary steps for accurately completing the form online, ensuring compliance with state regulations.

Follow the steps to efficiently complete the OK OTC 901 form online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Complete the header section by filling in your RE# and PP#. Provide your name or DBA (Doing Business As) and mailing address.

- Indicate whether you are renting or leasing the business location by selecting 'Yes' or 'No.' If you are renting, specify if you own any real estate improvements at that location.

- Enter the date you started the business at the current location in the format MM/DD/YYYY.

- Report only tangible assets. Include your FEIN (Federal Employer Identification Number) and type of business. Also, specify if other businesses are included in this rendition and provide their details if applicable.

- Fill in the physical location details if it differs from your mailing address. Additionally, provide the contact person's name and phone number for audit purposes.

- Confirm if you are still in business at this location. If not, indicate where the business is and whether you still own the personal property.

- Enter the date of disposal or sale if applicable, and remember to stop here if the business has been disposed of or sold.

- Proceed to part two, where you will report Oklahoma taxable fixed assets. List the beginning total, any additions or deletions, and the ending total with respective original costs.

- Continue to part three, detailing your taxable inventory. Provide the average inventory total and any applicable exemptions.

- In part four, list any additions for the reporting year, detailing the year acquired, item number, description, and the original cost.

- In part five, note any deletions during the reporting year in similar detail.

- Fill out part six, which involves listing your monthly inventory amounts for each month of the reporting year.

- Finally, sign the form, ensuring that it is signed by the preparer and the taxpayer, and fill out the date and preparer's address and details.

- Once completed, save your changes, and use the options to download, print, or share the form as needed.

Complete your OK OTC 901 form online today to ensure accurate reporting and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file for homestead exemption in Oklahoma, homeowners must complete an application and submit it to their county assessor’s office. The process is straightforward and typically requires proof of ownership and residency. Familiarizing yourself with the OK OTC 901 requirements can facilitate a smooth filing experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.