Loading

Get Ok Otc Sts20002 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC STS20002 online

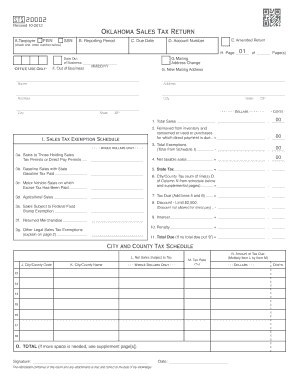

Filling out the OK OTC STS20002 form is essential for vendors responsible for collecting and remitting Oklahoma sales tax. This guide provides step-by-step instructions to help you accurately complete the online version of this form.

Follow the steps to effectively complete the OK OTC STS20002 form.

- Press the ‘Get Form’ button to access the form and open it in the online editor. This will allow you to begin filling it out.

- In Item A, ensure that the preprinted information is correct. If not, check the box next to the type of identification number being used and enter your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as appropriate.

- For Item B, enter the month(s) and year for the sales being reported. Begin with the month when you made your first sale.

- In Item C, provide the due date for the return. Make sure this is accurate to avoid penalties.

- If your account number is not preprinted, input it in Item D.

- If this is an amended return, check the box in Item E.

- If you are out of business, indicate this by checking Box F and provide the date you ceased operations.

- Should your mailing address have changed, check Box G and enter the new address in the appropriate fields.

- Refer to Line 1 to enter total sales, which includes gross receipts of all sales. If no sales occurred during the reporting period, you may leave this blank.

- For Line 2, report the value of any inventory that was removed and consumed for the reporting period.

- Complete the Sales Tax Exemption Schedule in Item I, using lines 3a through 3g to total all exemptions.

- Calculate your net taxable sales by subtracting the exemptions (Line 3) from the total of lines 1 and 2.

- Determine the state tax owed by multiplying your net taxable sales (Line 4) by the applicable tax rate.

- For city/county tax, use the City and County Tax Schedule to document the taxable sales and tax due for each city or county.

- Add lines 5 and 6 to compute the total tax due before any discounts, interests, or penalties are applied.

- If applicable, deduct any discount for timely payments, calculate interest due for late payments, and determine any penalties applicable.

- Total the calculations on Line 11 to find the final amount due.

- Sign and date the return, then proceed to mail it with your payment to the Oklahoma Tax Commission.

Complete your Oklahoma Sales Tax Return online today to ensure compliance and avoid penalties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The Oklahoma state refund tracker is available on the Oklahoma Tax Commission's official website. This tool allows you to monitor the status of your refund related to the OK OTC STS20002. Simply enter the required information to get real-time updates on your refund process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.