Loading

Get Or 150-101-062 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 150-101-062 online

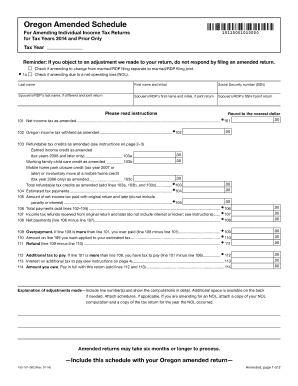

The OR 150-101-062 is the Oregon Amended Schedule for amending individual income tax returns for tax years 2014 and prior. This guide provides comprehensive instructions on how to fill out this form accurately and efficiently, ensuring you understand each component involved in the process.

Follow the steps to complete the OR 150-101-062 online successfully.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your last name, first name and initial, and Social Security number (SSN) in the designated fields. If you are filing a joint return, also include your spouse's or partner's information.

- Indicate the reason for amending your return by checking the appropriate box at the top of the form. Options include changing from married/RDP filing separate to married/RDP filing joint or amending due to a net operating loss (NOL).

- Proceed to fill out the financial sections, including amount for net income tax as amended, Oregon income tax withheld as amended, and refundable tax credits, rounding each amount to the nearest dollar.

- In the explanation section, provide a detailed account of the changes made, including applicable line numbers and computations. Use additional pages if necessary.

- After filling out the entire form, review all entries for accuracy. Ensure all required schedules and documentation are attached, based on your specific situation.

- Once you have completed the form and checked it for accuracy, you can save your changes, download or print the document, and prepare it for submission.

Take action now and fill out your OR 150-101-062 online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Typically, you can expect to receive your ITIN number within 7 to 11 weeks after applying. However, if more documentation is required, it may take longer. For a smoother process, consider using US Legal Forms for a well-structured application supporting the revision of necessary forms like OR 150-101-062.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.