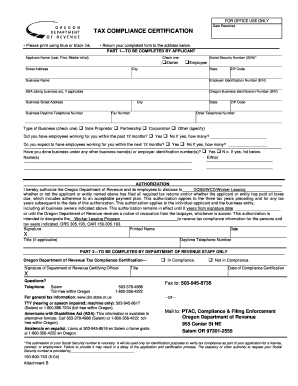

Get Or Dor 150-800-743 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign OR DoR 150-800-743 online

How to fill out and sign OR DoR 150-800-743 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out tax forms can become a major challenge and a severe annoyance if adequate help is not provided.

US Legal Forms has been established as an online solution for OR DoR 150-800-743 e-filing and presents several benefits for taxpayers.

Utilize US Legal Forms to ensure safe and straightforward completion of OR DoR 150-800-743.

- Locate the template on the website in the designated section or through the search feature.

- Hit the orange button to access it and wait for it to load.

- Examine the template and adhere to the guidelines. If you are unfamiliar with the form, follow the step-by-step instructions.

- Pay attention to the highlighted fields. These are editable and require precise information to be entered. If uncertain about what to input, refer to the guidelines.

- Always sign the OR DoR 150-800-743. Use the integrated tool to create your e-signature.

- Click on the date field to automatically insert the correct date.

- Review the document again to verify and amend it before e-filing.

- Press the Done button on the top menu once you have finished it.

- Save, download, or export the completed form.

How to modify Get OR DoR 150-800-743 2004: personalize forms online

Maximize the benefits of our all-inclusive online document editor while preparing your forms. Finalize the Get OR DoR 150-800-743 2004, highlight the most crucial details, and easily make any further necessary adjustments to its content.

Creating documents digitally is not only efficient but also provides an opportunity to modify the template according to your specifications. If you plan to handle the Get OR DoR 150-800-743 2004, consider completing it with our powerful online editing tools. Whether you mistype or input the required information in the wrong section, you can swiftly adjust the document without having to restart it from scratch as with manual completion. Moreover, you can emphasize the vital information in your paperwork by highlighting certain elements with colors, underlining them, or encircling them.

Our powerful online solutions are the easiest way to fill out and personalize Get OR DoR 150-800-743 2004 according to your needs. Utilize it to create personal or business documents from anywhere. Access it in a browser, make any modifications in your forms, and revisit them at any point in the future - they will all be securely stored in the cloud.

- Open the form in the editor.

- Fill in the necessary information in the blank fields using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don’t overlook any important fields in the template.

- Circle some of the essential details and add a URL to it if necessary.

- Utilize the Highlight or Line options to emphasize the most important facts.

- Select colors and thickness for these lines to give your form a professional appearance.

- Erase or blackout the information you wish to keep hidden from others.

- Correct portions containing errors and input the text that you require.

- Conclude editing with the Done option once you verify everything is accurate in the document.

Related links form

Oregon state tax forms are readily available through the Oregon Department of Revenue's website. With resources available under OR DoR 150-800-743, you can easily locate and download the forms you need. Furthermore, if you prefer a more guided approach, US Legal Forms can assist you in obtaining the correct forms quickly and accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.