Loading

Get Or Dor 41 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR DoR 41 online

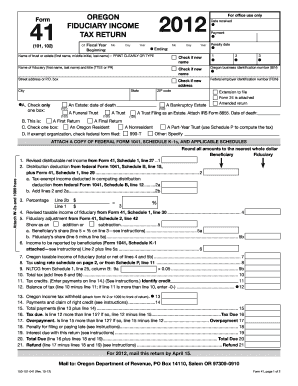

Filling out the Oregon Fiduciary Income Tax Return (Form 41) online can streamline the process and ensure that all necessary components are properly addressed. This guide provides you with step-by-step instructions to complete the form efficiently and accurately.

Follow the steps to fill out the OR DoR 41 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name and address of the trust or estate clearly, ensuring to check the boxes for relevant sections such as 'Check if new name' or 'Check if new address' as applicable.

- Select the type of return you are submitting by checking one of the boxes provided, including options for an 'Estate', 'Trust', or 'Bankruptcy Estate'.

- Input the Oregon business identification number (BIN) and federal employer identification number (FEIN) in the designated fields.

- Indicate whether this is a first return, a final return, or if you are requesting an extension to file by checking the appropriate boxes.

- Complete the revised distributable net income and any adjustments that may affect the taxable income of the fiduciary; refer to the calculations in the schedules.

- Calculate the tax due using the rate schedule provided on page 2 of Form 41, ensuring to account for any claimed credits.

- If applicable, check the box indicating any Oregon income tax withheld, and attach any necessary Form W-2 or 1099 documentation.

- Review all entered information for accuracy and completeness before finalization.

- Once satisfied with the form, save your changes, and choose to download or print the completed Form 41 to mail to the Oregon Department of Revenue.

Complete your fiduciary income tax return online today for a more efficient filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file Form 941 electronically through the IRS e-file system. This method streamlines the process, ensuring you're adhering to current regulations under the OR DoR 41. Consider using trusted platforms that offer e-filing solutions to simplify your experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.