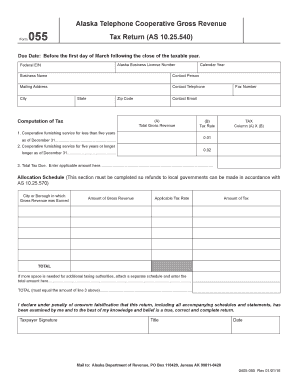

Get Ak Dor 055 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AK DoR 055 online

How to fill out and sign AK DoR 055 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the taxation timeframe began suddenly or perhaps you merely overlooked it, it might likely lead to complications for you. AK DoR 055 is not the simplest form, but you need not feel anxious regardless.

By utilizing our expert service, you will gain insight on how to accurately fill out AK DoR 055 even in moments of significant time constraints. Simply adhere to these straightforward instructions:

With our robust digital solution and its professional tools, the process of submitting AK DoR 055 becomes simpler. Don’t hesitate to engage with it and allocate more time for your passions instead of file preparation.

Access the document with our specialized PDF editor.

Complete the required information in AK DoR 055, utilizing fillable sections.

Incorporate graphics, marks, checks, and text boxes, as necessary.

Repeated fields will auto-populate after the initial entry.

If you encounter any challenges, activate the Wizard Tool. You will receive helpful hints for easier completion.

Always remember to include the application date.

Create your distinct e-signature once and place it in all required locations.

Review the information you have entered. Amend errors if needed.

Select Done to complete editing and choose how you would like to submit it. You can opt for online fax, USPS, or email.

You have the option to download the file for later printing or upload it to cloud storage services such as Dropbox, OneDrive, etc.

How to modify Get AK DoR 055 2016: personalize forms online

Check out an independent service to manage all your documentation effortlessly.

Locate, modify, and finalize your Get AK DoR 055 2016 in a singular interface with the assistance of innovative tools.

The era when individuals had to print forms or even write them manually is over. Nowadays, all it requires to locate and finalize any form, such as Get AK DoR 055 2016, is opening merely one browser tab.

Here, you will discover the Get AK DoR 055 2016 form and tailor it in any fashion you require, from embedding text directly into the document to sketching it on a digital sticky note and attaching it to the file. Uncover tools that will simplify your documentation without unnecessary effort.

Utilize additional tools to personalize your form: Use Cross, Check, or Circle tools to highlight the document's details. Include textual content or fillable fields with text alteration tools. Remove, emphasize, or obscure text sections in the document using appropriate tools. Insert a date, initials, or even an image to the file if necessary. Employ the Sticky note tool to annotate the form. Use the Arrow and Line, or Draw tool to add graphic features to your document. Preparing Get AK DoR 055 2016 forms will never be confusing again if you know where to look for the right template and prepare it efficiently. Do not hesitate to give it a try.

- Simply click the Get form button to prepare your Get AK DoR 055 2016 documentation swiftly and start modifying it right away.

- In the editing mode, you can conveniently fill out the template with your information for submission.

- Just click on the area you wish to alter and input the data instantly.

- The editor's interface does not require any special expertise to operate.

- When you have completed the edits, verify the information's precision once again and endorse the document.

- Click on the signature area and follow the directions to eSign the form in no time.

Related links form

States without an income tax often rely on alternative revenue sources, such as sales taxes, property taxes, or specific industry taxes. By diversifying their revenue streams, they can offer public services without taxing residents' income. This model fosters a unique economic environment, attracting new residents and businesses. For insights on how these structures work effectively, AK DoR 055 is an excellent resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.