Loading

Get Nc Dor D-400x-ws 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-400X-WS online

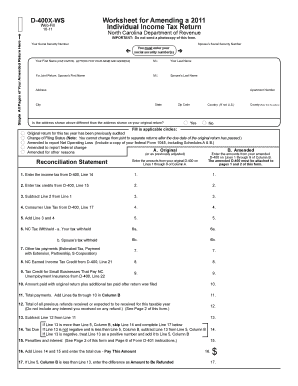

Filling out the NC DoR D-400X-WS form can be essential for amending your individual income tax return. This guide provides a clear and supportive walkthrough to help you complete the necessary fields online, ensuring that your submissions are accurate and timely.

Follow the steps to accurately complete the NC DoR D-400X-WS online.

- Use the ‘Get Form’ button to access the NC DoR D-400X-WS form and open it in your online editor.

- Begin by entering your social security number and your partner’s social security number if filing jointly. Ensure the information is accurate.

- Fill in your first name, middle initial, and last name using capital letters for clarity.

- If filing jointly, add your partner's details including their first name, middle initial, and last name.

- Provide your address, apartment number (if applicable), city, state, zip code, and country if it's not the U.S.

- Indicate if the address is different from the one shown on the original return by selecting 'Yes' or 'No.'

- Fill out the sections regarding changes, including any applicable circles for original return audits, change of filing status, net operating loss claims, or other reasons for amendment.

- Complete the reconciliation statement, entering amounts from your D-400 form in the respective columns for amended and original returns.

- Sign and date the form, indicating that the information provided is accurate to the best of your knowledge.

- Finally, save changes, and choose to download, print, or share your filled-out form as necessary.

Complete your tax documents online today for a smoother filing experience.

The NC D 400 form is the primary tax form for individual income tax returns in North Carolina. It is essential for residents who need to report their income and calculate tax liability. Utilizing the NC DoR D-400X-WS in conjunction with the D 400 form ensures you are adhering to state guidelines while efficiently managing your tax responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.