Loading

Get Irs 720 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 720 online

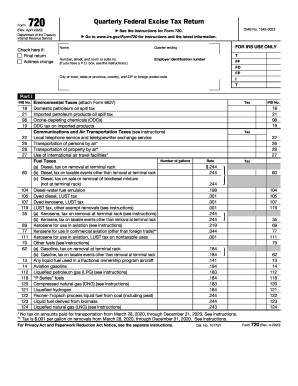

The IRS 720 form is a crucial document for reporting quarterly federal excise taxes. This guide provides clear, step-by-step instructions to help users effectively complete the form online, catering to those with varying levels of experience.

Follow the steps to accurately complete the IRS 720 online.

- Press the ‘Get Form’ button to access the IRS 720 form and open it in your editor.

- Fill in your name and address in the designated fields at the top of the form, ensuring that all information is accurate and properly formatted.

- Indicate the quarter ending date for which you are filing by selecting the appropriate option.

- Provide your employer identification number in the specified section, ensuring that it is current.

- Complete Part I, detailing your excise tax liabilities by filling out the relevant lines for various tax categories. Be sure to attach additional forms if required.

- Proceed to Part II, where you will report any applicable Patient-Centered Outcomes Research Fees and calculate totals as instructed.

- In Part III, total the amounts from Parts I and II. Calculate any deposits made, and note any claims.

- Check if there is any overpayment and indicate how you would like the overpayment to be managed: applied to your next return or refunded.

- Designate a third-party designee if applicable, providing their name and contact information.

- Sign and date the form, ensuring all required areas are filled out completely.

- Once you have confirmed all provided information is accurate, save your changes and choose to download, print, or share the completed form as required.

Start filling out your IRS 720 online today to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

An IRS clearance letter is documentation that indicates you have no outstanding tax liabilities with the IRS. This letter can be crucial for businesses seeking to secure contracts or licenses. Obtaining this letter can be simplified with resources from US Legal Forms, which guide you through the process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.