Loading

Get Oh Dte 105a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH DTE 105A online

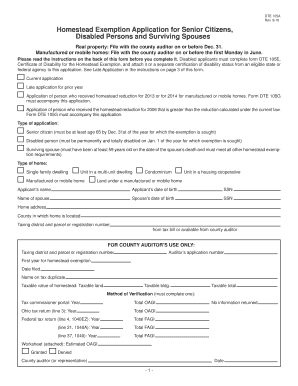

The OH DTE 105A form is essential for individuals seeking a homestead exemption for senior citizens, disabled persons, and surviving spouses. This guide walks you through the steps to complete this application online, ensuring clarity and ease for all users, regardless of their legal knowledge.

Follow the steps to complete the OH DTE 105A online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Read the instructions on the back of the form carefully to understand the requirements and eligibility criteria for the homestead exemption.

- Select the type of application by checking the appropriate box: Current application, Late application for the prior year, or other specified options.

- Indicate the type of home you own by selecting one of the following options: single family dwelling, unit in a multi-unit dwelling, manufactured or mobile home, condominium, unit in a housing cooperative, or land under a manufactured or mobile home.

- Fill out the applicant's name, date of birth, social security number, and spouse’s details if applicable.

- Provide the home address and specify the county where the home is located along with the taxing district and parcel or registration number from your tax bill.

- Complete the method of verification section by selecting one of the verification methods, detailing the year and total amounts as necessary.

- Review the form to ensure all information is accurate, and declare under penalty of perjury that the information provided is true.

- Sign the application and provide the date, phone number, and email address before submitting.

- After completing the form, save your changes, download a copy for your records, and share or print as required.

Complete your OH DTE 105A form online today for a timely submission!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To apply for the Homestead Exemption in Ohio, complete the OH DTE 105A form, which is available from your county auditor's office or online. Along with the completed form, submit evidence of your income and residency. Be mindful of deadlines to submit your application, as timely filing is essential to gaining eligibility for the exemption.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.