Loading

Get Md Met 1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD MET 1 online

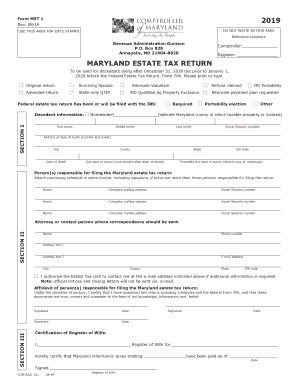

The Maryland estate tax return (MD MET 1) is a crucial form for reporting estate tax for decedents who passed away after December 31, 2018 but before January 1, 2020. This guide provides step-by-step instructions on how to complete this form online, ensuring that all necessary information is accurately captured.

Follow the steps to complete the MD MET 1 online.

- Press the ‘Get Form’ button to access the MD MET 1 document and open it in your preferred digital format.

- Indicate the type of return you are filing. Clearly state whether this is an original or amended return, and if there is a surviving spouse. This includes marking if any elections, such as QTIP or alternate valuation, are being made.

- Complete Section I with the decedent's information including the first name, middle name, last name, Social Security number, address at the date of death, and the date of death.

- List any person(s) responsible for filing the return in Section II. Ensure to provide their names, complete mailing addresses, and Social Security numbers.

- In Section III, provide the signature and date where each responsible party certifies the return as true and correct.

- For Section IV, compute the Maryland estate tax by entering the amounts specified, following the specific lines for deductions and assessment as outlined on the form.

- Attach any necessary schedules and documents including the federal estate tax return (Form 706), and any completed Maryland schedules such as Schedule A, B, C, D, and F.

- Review all information for accuracy. Save your changes to the document, then proceed to download or print the completed MD MET 1 form for submission with any required attachments.

Complete your Maryland estate tax return online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Certain assets, such as life insurance proceeds and retirement accounts, may not be subject to estate tax in Maryland, depending on how they are structured. It's essential to understand how each asset class is treated under the MD MET 1 guidelines. An expert in estate planning can help clarify this for you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.