Loading

Get Wi I-119 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the WI I-119 online

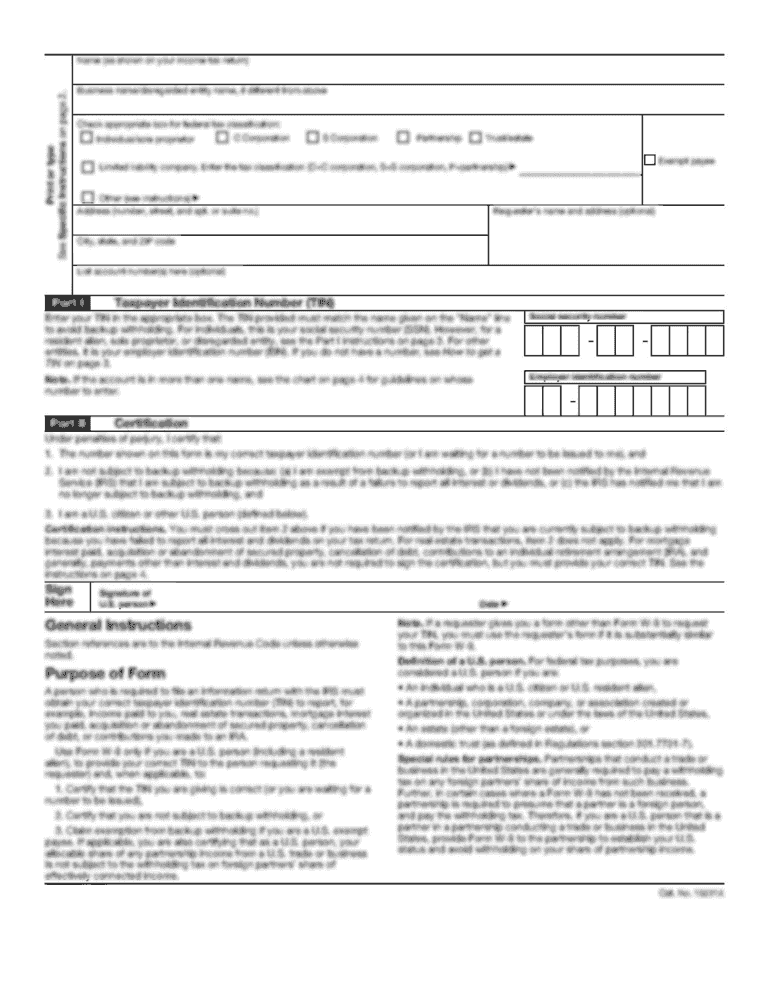

The WI I-119 form is essential for those who sell or dispose of assets with differing bases for Wisconsin and federal income tax purposes. This guide aims to provide clear and supportive instructions on how to fill out the form online efficiently.

Follow the steps to complete the WI I-119 accurately.

- Press the ‘Get Form’ button to access the WI I-119 and open it in your preferred editor.

- Begin with Part I for adjustments related to capital assets sold or disposed of in 2019. Determine if your asset has a different basis for Wisconsin compared to federal purposes. Fill in the necessary details about each asset based on their holding period.

- Proceed to Part II if you reported sales on federal Form 4797, ensuring that you provide the appropriate descriptions and bases for the assets. Follow the outlined steps to recompute your federal Form 4797 using the Wisconsin basis.

- Complete Part III if you have acquired changing basis assets, filling in the adjustments necessary for differences in basis over the asset's lifecycle.

- After thoroughly checking your entries, save any changes made on the form. You will then have options to download, print, or share the completed document as needed.

Complete your tax documents online to ensure accurate submissions and timely processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Line 119 on the T4A refers to a specific reporting line related to payments received, often associated with scholarships or grants. It is crucial for recipients to properly report this income when filing taxes, as it impacts their overall tax obligations. To clarify the implications of line 119 and ensure compliance with your WI I-119 filing, the resources available at US Legal Forms can be invaluable.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.