Loading

Get Az Dor 140es 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ DoR 140ES online

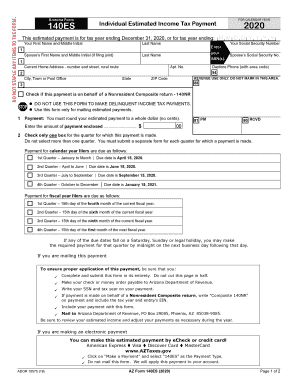

This guide provides clear, step-by-step instructions for filling out the Arizona Department of Revenue Form 140ES online. The AZ DoR 140ES is used for making estimated income tax payments, ensuring compliance with state tax obligations.

Follow the steps to fill out the AZ DoR 140ES online effectively.

- Click the ‘Get Form’ button to obtain the AZ DoR 140ES form and open it in your preferred digital editor.

- Begin by entering your first name and middle initial in the designated field.

- Next, enter your last name. If you are filing jointly, include your spouse's first name, middle initial, and last name as well.

- Provide your current home address, including the number and street, city, and ZIP code.

- Enter both your Social Security Number and, if applicable, your spouse’s Social Security Number in the specified fields.

- Fill in your daytime phone number, ensuring that the area code is included.

- Indicate whether this payment is on behalf of a nonresident composite return by checking the appropriate box if applicable.

- Round your estimated payment to the nearest whole dollar and input this figure in the payment amount field.

- Select the appropriate quarter for which the payment is being made by checking the corresponding box; ensure only one box is selected.

- Review the payment deadlines for your category (calendar year or fiscal year) to confirm timely submission for the selected quarter.

- If mailing the form, ensure to complete it fully, make the check or money order payable to the Arizona Department of Revenue, and include your SSN and tax year on the payment.

- For electronic payments, follow the specified instructions to complete your payment without mailing the form.

- Once all fields are complete, save your changes, then choose to download, print, or share the form as required.

Complete your estimated tax payments online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can typically find some tax forms, including the Arizona form 140, at your local post office during tax season. However, availability may vary, so it's a good idea to check ahead. To ensure you have the proper forms, consider visiting the Arizona Department of Revenue online or accessing forms through uslegalforms for convenience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.