Loading

Get Pa Dor 83-e669 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR 83-E669 online

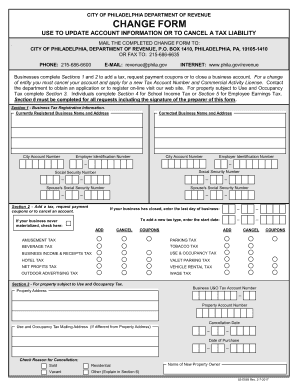

This guide provides comprehensive instructions on how to fill out the PA DoR 83-E669 form online for updating account information or cancelling a tax liability. Whether you are a business or an individual, following these steps will ensure a smooth process.

Follow the steps to complete the PA DoR 83-E669 form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by completing Section 1, which includes providing the currently registered business name, address, city account number, and employer identification number. Ensure all the information is accurate to avoid processing delays.

- Proceed to Section 2 to add a tax, request payment coupons, or indicate account cancellation. If your business is closed, enter the last day of business. If you are adding a new tax type, include the start date as well.

- For properties subject to Use and Occupancy Tax, complete Section 3 with the property address and business U&O tax account number. If applicable, state the reason for cancellation in the designated area.

- In Section 4, for school income tax, correct any pre-printed information. Indicate any necessary changes such as a deceased spouse or change of address and ensure to fill in the appropriate Social Security numbers.

- Complete Section 5 for employee earnings tax; provide the current and corrected taxpayer names and addresses accordingly, along with reasons for cancellation if relevant.

- Finally, Section 6 requires the contact information, a printed name, date, signature, and additional contact details such as phone number or email address. This section must be filled out for all requests.

- After reviewing the form for accuracy, save your changes and choose to download, print, or share the completed PA DoR 83-E669 form as needed.

Complete your documents online with confidence and efficiency.

Related links form

The 1040EZ form requires basic personal information, total income amounts, and details on any tax withholding. You will also need to report your tax refund or amount owed. To ensure you capture all necessary information, consult the PA DoR 83-E669 for guidance on filling out the form accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.