Loading

Get Irs 8917 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8917 online

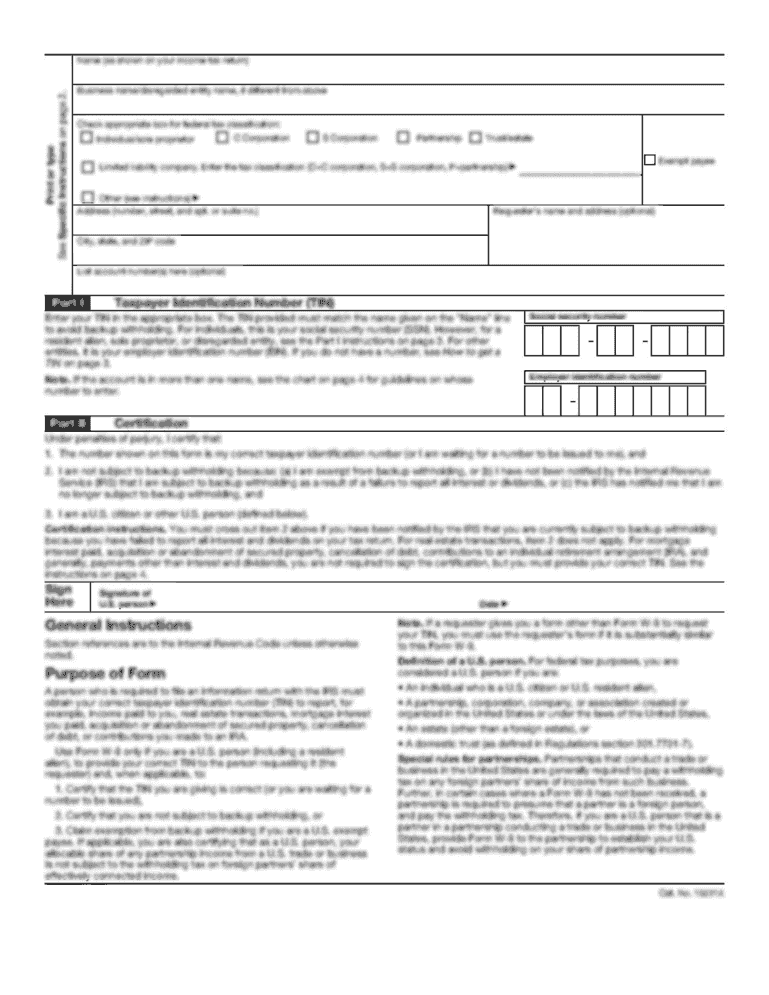

Filling out the IRS 8917 form online can be a straightforward process if you understand its components and instructions. This guide aims to assist you in completing the Tuition and Fees Deduction form efficiently and accurately.

Follow the steps to fill out the IRS 8917 form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the student’s name and social security number in the fields provided. Make sure the name matches what is shown on your tax return.

- In column (c) on line 1, enter the adjusted qualified education expenses for each student. This should reflect the educational expenses you paid during the current tax year.

- Add the amounts you entered in column (c) for each student and input the total on line 2.

- Enter the total income amount from your Form 1040 or 1040-SR on line 3. This will help determine your eligibility for the deduction.

- Calculate the difference by subtracting line 4 from line 3 and input the result on line 5. If your income exceeds the specified limits, additional deductions may not apply.

- On line 6, assess whether the amount from line 5 exceeds $65,000 (or $130,000 if married filing jointly). Enter the appropriate deduction amount based on your findings.

- Ensure all entries are accurate, and review the completed form for any missing information.

- Once you have finished, you may choose to save changes, download, print, or share the form as needed.

Complete your IRS 8917 form online today to ensure you claim your eligible educational deductions.

Form 8917 is used for claiming the tuition and fees deduction on your federal tax return. This deduction helps eligible students reduce their taxable income by accounting for qualified education expenses. By effectively using the IRS 8917, you can potentially lower your tax liability and enhance your overall financial situation while pursuing education.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.