Loading

Get Ct Drs Ct-eitc Seq 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-EITC SEQ online

This guide provides clear and supportive instructions for completing the CT DRS CT-EITC SEQ form online. By following these steps, users can effectively fill out the questions and ensure they submit the necessary information accurately.

Follow the steps to complete your CT DRS CT-EITC SEQ form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

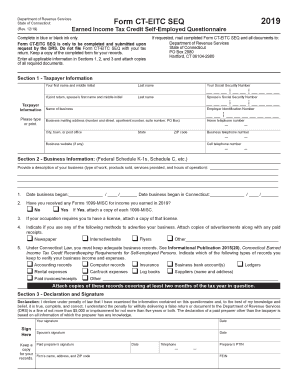

- In Section 1, enter your first name, middle initial, and last name, followed by your Social Security Number. If you are filing jointly, include your spouse’s name and Social Security Number.

- Provide the name of your business and its Employer Identification Number. Fill in the business mailing address, including street number, apartment or suite number, and city, state, and ZIP code. Lastly, provide your home and business telephone numbers, business website if applicable, and your cell telephone number.

- Move to Section 2, where you describe your business activity (type of work and services). Indicate the date your business began and the date it began operating in Connecticut. If you received any Forms 1099-MISC for income earned in 2019, signify yes or no and attach copies as required.

- If applicable, attach a copy of any required business licenses. Choose the methods you use to advertise your business by checking the relevant options, and attach copies of advertisements and paid receipts.

- Indicate the types of records you maintain to verify your business income and expenses. Ensure to attach copies of these records covering at least two months of the tax year.

- In Section 3, read the declaration carefully. Sign and date the form, including your spouse’s signature if filing jointly. Ensure to also fill in the date and contact number.

- Once all sections are completed and reviewed, save your changes, and you have the option to download, print, or share the form as needed.

Complete your documents online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Connecticut Earned Income Tax Credit (CT EITC) is designed to provide financial relief to low to moderate-income working families. This credit reduces your tax liability or increases your refund, offering substantial support. By claiming this credit through your Connecticut income tax return, you can enhance your financial situation. Learn how to apply for it through the CT DRS CT-EITC SEQ.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.