Loading

Get Ca Ftb 100w 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 100W online

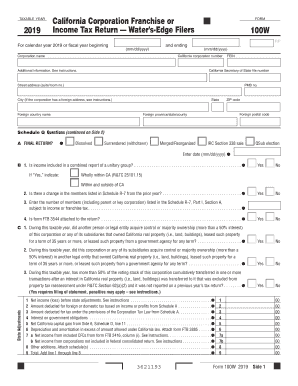

The CA FTB 100W form is essential for California corporation franchise or income tax returns, specifically for water's-edge filers. Completeness and accuracy in filling this form online is crucial for compliance and tax liability.

Follow the steps to fill out the CA FTB 100W form accurately.

- Press the ‘Get Form’ button to access the CA FTB 100W form online.

- Begin by entering your corporation's name and California corporation number. Ensure accuracy as this information is crucial for identification.

- Fill out the street address, city, state, zip code, and additional address details if applicable. If your corporation has a foreign address, refer to the instructions located within the form.

- Indicate if this is a final return by checking ‘Yes’ or ‘No,’ and provide the date if applicable.

- Proceed to answer the Schedule Q questions, ensuring to mark any if applicable, such as mergers or reorganizations.

- Report your net income or loss before state adjustments in the appropriate fields, and fill in any deductions based on previous schedules.

- Complete the section addressing California capital gains and losses as necessary, including forms attached.

- Finalize by reviewing your entries for errors, then save your changes, download the completed form, and print or share it as needed.

Complete your CA FTB 100W form online to ensure compliance and accuracy in your corporate tax filings.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

FTB form 100W is designed for corporations that need to report income not subject to California taxation. This specialized form allows businesses to accurately detail their financial activities and relevant deductions. Using form 100W correctly helps corporations navigate their tax responsibilities and minimize their obligations under California tax law.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.