Loading

Get Vt Dot S-3c 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT DoT S-3C online

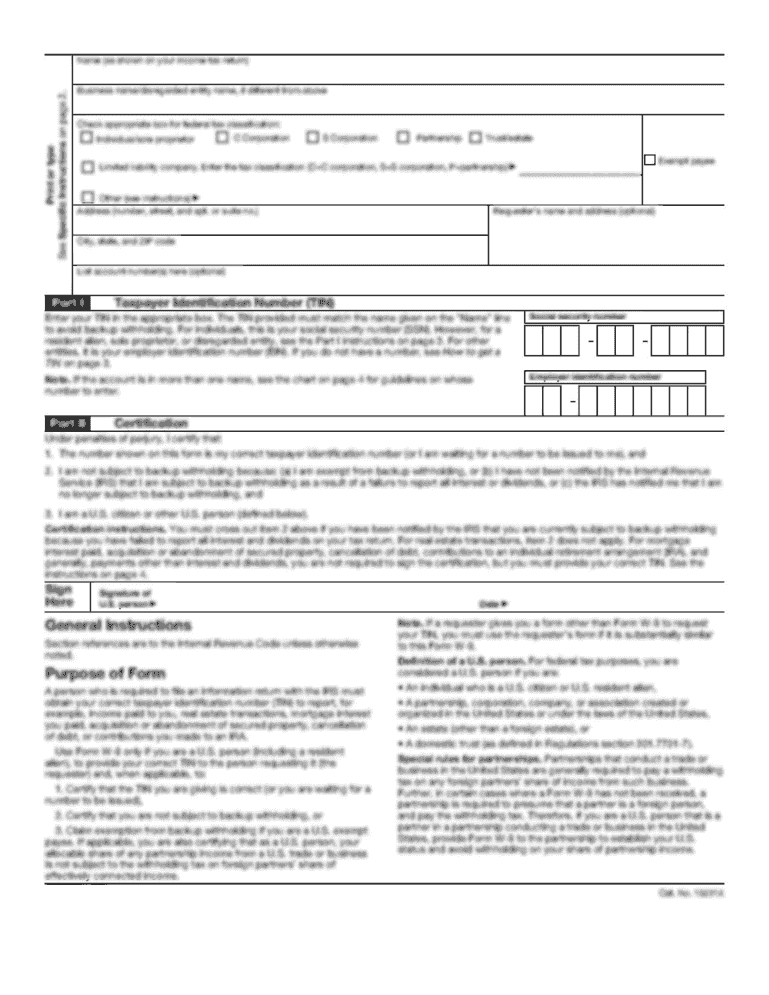

The Vermont Sales Tax Exemption Certificate (Form S-3C) is essential for contractors completing qualified exempt projects. This guide will help you navigate the online process of filling out this form accurately and efficiently.

Follow the steps to successfully complete the VT DoT S-3C online.

- Press the ‘Get Form’ button to access the exemption certificate and open it in your preferred editing interface.

- Identify your status as a contractor, and fill in the required details. Indicate whether this is for a single purchase or multiple purchases. If multiple, be aware that it will be effective for subsequent purchases.

- In the contractor section, enter your name, Federal ID Number (if applicable), business name, and address. Make sure to include your city, state, and ZIP code.

- If you are an individual or partnership, provide your Social Security Number and telephone number.

- Proceed to the seller section. Fill in the seller’s name, address, and city. Include the organization’s name if applicable.

- Complete the exempt organization section, indicating how your project qualifies for exemption. Choose from the provided options: 501(c)(3) organization, United States government agency, State of Vermont or subdivision, local development corporation, or qualifying manufacturing facility.

- Fill in the project starting date and approximate completion date required for the exemption.

- Finally, certify the accuracy of the information by providing the signature of the buyer or authorized agent, along with their title and the date of signing.

- Once you have reviewed the form for completeness, save your changes. You can then download, print, or share the completed form as necessary.

Complete your Vermont Sales Tax Exemption Certificate online today!

Yes, Vermont requires businesses to have a registered agent for service of process. This agent must have a physical address in Vermont and be available during business hours. Having a registered agent can help you navigate legal responsibilities more smoothly, including those outlined in the VT DoT S-3C.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.