Loading

Get Ak Form 6100 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 6100 online

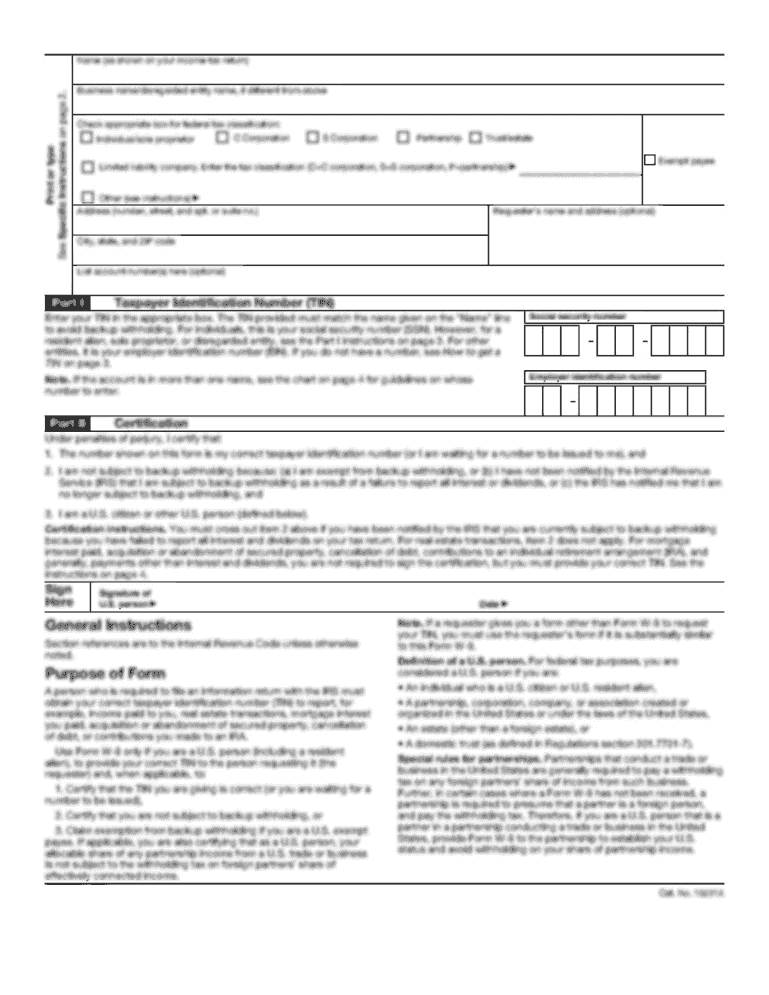

Filling out the AK Form 6100 online can be a streamlined process when you understand each component of the form. This guide provides step-by-step instructions to assist you in completing your Alaska Oil and Gas Corporation Net Income Tax Return effectively.

Follow the steps to complete the AK Form 6100 online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred online editor.

- Begin by filling in your Employer Identification Number (EIN) at the top of the form. Ensure this is accurate to avoid processing delays.

- Input the NAICS code, contact person's name, title, mailing address, city, state, and zip code in the corresponding fields.

- Indicate the contact email address and telephone number. If there is a new address, check the appropriate box.

- Check the applicable return information boxes, such as whether this is a final return or if a federal extension is in effect.

- Proceed to Schedule A, where you will summarize your net income. Input your Alaska income from Schedule G and indicate any net operating losses utilized.

- Complete the line for Alaska income tax and any other taxes you need to report from Schedule E. Ensure all figures add correctly.

- In the final section, review your entries for accuracy. You will have options to save your changes, download, print, or share the form.

Start completing your AK Form 6100 online today to ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

No, Alaskans are not required to file a state tax return because Alaska does not impose a state income tax. However, if you receive income or need to report specific transactions, you may find it beneficial to use forms like AK Form 6100. This form helps simplify filing federal taxes and can provide clarity on any applicable federal tax obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.