Get Or Or-65-v 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR OR-65-V online

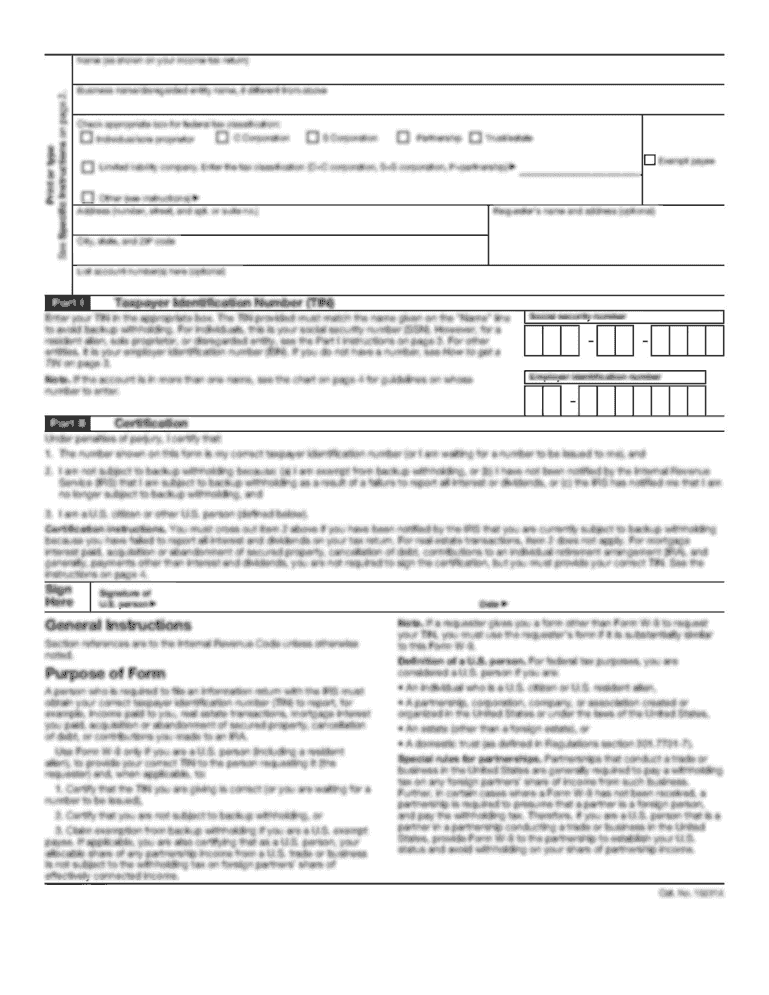

Filling out the OR OR-65-V form online can be a straightforward process when you understand each component of the form. This guide is designed to help you navigate the sections and fields efficiently and effectively.

Follow the steps to complete the OR OR-65-V online

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the tax year for which you are making the payment by providing the beginning and end dates. For example, for the year 2019, you would enter: Begins: 01/01/2019, Ends: 12/31/2019.

- Select the payment type by checking the appropriate box for the type of payment you are submitting. Choose from original return, amended return, or extension payment.

- Fill out the taxpayer information completely. Ensure that your name, mailing address, city, state, ZIP code, and contact phone number are accurate. If your address has changed since your last filing, please complete a Change of Address/Name form and send it separately to the department.

- Clearly indicate the payment amount by writing it in the designated field, ensuring the format is correct.

- Once you have filled out all necessary fields, review your information for accuracy. Adjust the view size to 100 percent if viewing the form electronically to avoid display issues.

- After verifying your information, save the changes. You can then download, print, or share the completed form as necessary.

Complete your OR OR-65-V form online today and ensure timely processing of your payment.

Get form

For your Oregon state tax return, including the OR OR-65-V form, you should mail it to the appropriate address listed specifically for state returns in the Oregon tax instructions. This ensures that your return is processed correctly and swiftly. Always verify the mailing address on the official Oregon Department of Revenue website, as it is subject to change. Resources like uslegalforms can help streamline the filing process and provide clear mailing instructions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.