Get Hi Dot N-139 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI DoT N-139 online

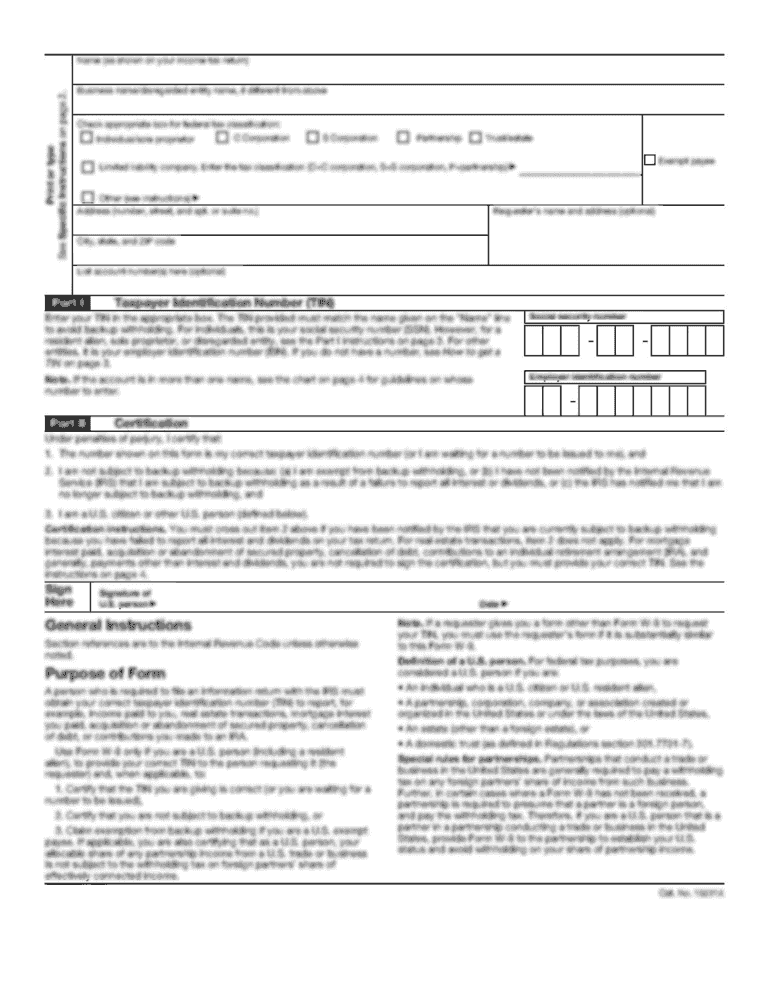

Completing the HI DoT N-139 form online can seem daunting, but with this guide, you will have a clear understanding of each section of the form. This document allows users to deduct moving expenses related to a new workplace, ensuring you get the benefits you deserve.

Follow the steps to successfully fill out the HI DoT N-139 online.

- Click the ‘Get Form’ button to access the HI DoT N-139 form and open it in your online editor.

- Enter the tax year at the beginning of the form, specifying the year in which your moving expenses occurred.

- In the Name section, provide your name(s) as shown on Form N-11 or N-15. This ensures your details are accurately reflected.

- Input your Social Security Number in the designated field. This is necessary for identification and processing.

- Indicate whether you are deducting moving expenses for relocating within Hawaii or moving outside of Hawaii by checking the appropriate box.

- List the addresses for your old home, new workplace, and old workplace in the corresponding fields for clarity and accuracy.

- Enter the number of weeks you have worked at your new workplace in the specified field.

- Calculate the distance from your old home to your new workplace. Input this distance in the provided field.

- Calculate and enter the distance from your old home to your old workplace. This is required to complete the distance test.

- Subtract the distance to your old workplace from the distance to your new workplace and enter the result. If this number is zero or less, you cannot deduct your moving expenses.

- If line 3 indicates you meet the distance test, proceed to line 4 to enter the amount you paid for transportation and storage of your household goods.

- On line 5, denote the total amount spent on travel expenses from your old home to your new home, including lodging but excluding meals.

- On line 6, sum lines 4 and 5 to find your total moving expenses.

- On line 7, record any reimbursements received for moving expenses that are not included in your wage documentation.

- Determine if line 6 exceeds line 7. If it does not, you cannot deduct these moving expenses. If it does, subtract line 7 from line 6 and enter this figure on line 8 as your deductible moving expense.

- Once all fields are accurately completed, you can save your changes, download a copy of the form, print it, or share it as needed.

Complete your HI DoT N-139 form online today to ensure you maximize your moving expense deductions.

Get form

Related links form

To fill out a 1040EZ form, you needed to enter your personal information, income details, and any eligible deductions. Due to its discontinuation, it’s advisable now to seek alternate forms such as the revised 1040 for accurate filing. Make sure you know how the HI DoT N-139 influences your tax deductions. Our platform provides insights and support for filling out the current forms effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.