Loading

Get Ca Ftb 541 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 541 online

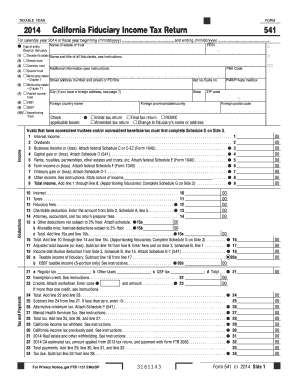

Filling out the CA FTB 541 form is a crucial step for fiduciaries managing estates or trusts in California. This guide provides a clear, step-by-step approach to seamlessly complete the form online, ensuring you accurately report income and deductions.

Follow the steps to complete the CA FTB 541 form online.

- Press the ‘Get Form’ button to obtain the CA FTB 541 form and open it in the online editor.

- Begin by selecting the type of entity by checking the appropriate box, such as decedent’s estate or simple trust. Provide the name of the estate or trust, and the Federal Employer Identification Number (FEIN) if applicable.

- Fill in the street address or P.O. Box for the estate or trust, ensuring to include any additional apartment or suite number and city.

- Indicate if this is the initial, final, amended tax return, or if there has been a change in fiduciary’s name or address by checking the relevant box.

- Input all income details on the income section, including interest, dividends, business income, capital gains, and any other applicable income sources.

- Calculate total income by adding all income lines from 1 through 8, and input this figure onto the Total income line.

- Proceed to the deductions section by entering specific deductions, including fiduciary fees and charitable deductions as guided.

- Complete the calculation for taxable income by following the instructions to subtract deductions from total income where necessary.

- Review all entered information for accuracy, ensuring all necessary fields and attached schedules are filled out as required.

- Once completed, save your changes, and then you may choose to download, print, or share the form.

Start filling out your CA FTB 541 form online today to stay compliant with California tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

California withholding applies to payments made to non-resident individuals and entities for services performed within the state. If you are a partnership making such payments, understanding withholding rules is crucial. Ensure you comply with state requirements to avoid penalties, particularly when filing CA FTB 541.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.