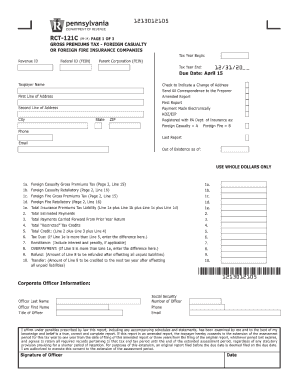

Get Pa Dor Rct-121c 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PA DoR RCT-121C online

How to fill out and sign PA DoR RCT-121C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Completing tax forms can become a significant barrier and substantial annoyance if adequate guidance isn't offered.

US Legal Forms is created as an online solution for PA DoR RCT-121C electronic filing and presents various benefits for taxpayers.

Utilize US Legal Forms to guarantee a convenient and straightforward PA DoR RCT-121C completion.

- Locate the template on the website within the appropriate section or through the search function.

- Click the orange button to access it and wait for it to load.

- Examine the form and pay close attention to the instructions. If you have never filled out the form before, adhere to the step-by-step guidelines.

- Concentrate on the yellow fields. These are fillable and require specific information to be included. If you're uncertain about what information to enter, review the recommendations.

- Always sign the PA DoR RCT-121C. Use the integrated tool to create an electronic signature.

- Select the date field to automatically insert the correct date.

- Review the form to ensure accuracy and make adjustments before submitting.

- Click the Done button in the top menu once you have finished.

- Save, download, or export the finalized form.

How to Adjust Get PA DoR RCT-121C 2014: Personalize Forms Online

Creating documents is more convenient with intelligent online resources. Remove physical paperwork using easily accessible Get PA DoR RCT-121C 2014 templates that you can alter online and print.

Drafting documents and paperwork should be more manageable, whether a regular part of one’s job or infrequent task. When someone needs to submit a Get PA DoR RCT-121C 2014, investigating guidelines and instructions on how to accurately complete a form and what it should encompass can demand considerable time and energy. Nevertheless, if you discover the appropriate Get PA DoR RCT-121C 2014 template, finalizing a document will become effortless with an intelligent editor available.

Explore a broader selection of functionalities that you can incorporate into your document workflow. There’s no need to print, complete, and annotate forms manually. With an intelligent editing platform, all the crucial document processing features will always be within reach. If you wish to enhance your workflow with Get PA DoR RCT-121C 2014 forms, locate the template in the directory, choose it, and find a more straightforward way to fill it out.

The more tools you familiarize yourself with, the easier it is to manage Get PA DoR RCT-121C 2014. Experiment with the solution that provides everything necessary to locate and modify forms in one browser tab and eliminate manual paperwork.

- If you need to insert text in any part of the form or add a text field, utilize the Text and Text field tools and expand the text in the form as much as necessary.

- Make use of the Highlight tool to emphasize the critical elements of the form. If you need to conceal or eliminate certain text portions, use the Blackout or Erase tools.

- Tailor the form by incorporating default graphic elements. Apply the Circle, Check, and Cross tools to add these components to the forms if necessary.

- If you require more annotations, take advantage of the Sticky note feature and place as many notes on the form page as needed.

- For instances where the form demands your initials or date, the editor provides tools for that as well. Minimize the risk of errors using the Initials and Date tools.

- It’s also simple to incorporate custom graphic elements into the form. Utilize the Arrow, Line, and Draw tools to personalize the document.

The PA inheritance tax form, known as the REV-1500, is essential for individuals dealing with an estate in Pennsylvania. This form must be filed to report the transfer of assets following a person's death, outlining the tax obligations of the beneficiaries. Ensuring accurate completion of this form is crucial to comply with state laws, particularly concerning the PA DoR RCT-121C. Accessing services from uslegalforms can simplify this complex process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.