Get Irs 433-b (sp) 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-B (SP) online

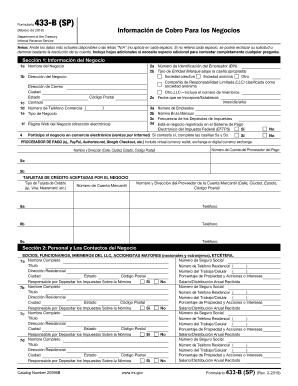

The IRS 433-B (SP) form is an essential document for businesses to report their financial information to the Internal Revenue Service. Filling out this form accurately is crucial for maintaining compliance and facilitating the proper management of your business finances. This guide will provide clear, step-by-step instructions to help you fill out the form online with ease.

Follow the steps to complete the IRS 433-B (SP) form online.

- Click the ‘Get Form’ button to obtain the IRS 433-B (SP) form and open it in your preferred format.

- Begin with Section 1: Provide your business information, including the business name, employer identification number (EIN), and entity type. Ensure that all fields are filled out, using 'N/A' if information does not apply.

- In Section 2, list the personal information of the business partners, officers, and major shareholders. Include their names, titles, contact information, and ownership percentages.

- Section 3 requires you to provide any additional financial information related to the business, including details about payroll service providers or any active litigation. Be thorough, as this section may require copies of relevant documentation.

- In Section 4, report on the business's liabilities and assets. Document cash available, bank accounts, receivables, investments, and any real property owned by the business. Ensure all amounts are accurate.

- Section 5 focuses on your business's monthly income and expenses. Detail your revenue sources and regular business expenses over a chosen period.

- Complete the certification section by signing and dating the form. Ensure that the name of the responsible person is printed clearly.

- Once all sections are completed, review your entries for accuracy. Save all changes, and choose to download, print, or share the completed form as needed.

Start filling out your IRS 433-B (SP) form online to ensure your business's financial reporting is accurate and complete.

To properly fill out form 843, start by providing your details like name, address, and tax identification number. Clearly indicate the reason for your request for abatement or refund, and attach any relevant supporting documents, including your IRS form 433-B (SP) if applicable. Review the form for completeness and accuracy before submission. Ensuring everything is in order can significantly enhance your chances of a favorable response.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.