Get Pa Dor Rev-1196 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA DoR REV-1196 online

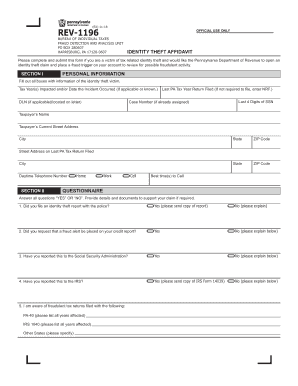

The PA DoR REV-1196 is an important form for individuals who are victims of tax-related identity theft. This guide will provide you with clear, step-by-step instructions for filling out the form online, ensuring you can successfully submit your claim to the Pennsylvania Department of Revenue.

Follow the steps to complete the PA DoR REV-1196 form online.

- Click the ‘Get Form’ button to access the PA DoR REV-1196 form and open it in your editor.

- In Section I, you need to fill in all boxes with the personal information of the identity theft victim. This includes details such as the tax year(s) impacted, last PA tax return filed, and the victim's name and contact information.

- Complete the questionnaire by answering all questions with either 'YES' or 'NO'. Provide any required details and documents that may support your claim.

- Move to Section III, where you will provide a detailed explanation of how your identity may have been compromised and how your tax account might be affected. If you need more space, you can attach another sheet.

- In Section IV, sign and date the certification. Make sure all entries are complete and accurate to the best of your knowledge, as this section declares the truthfulness of the information provided.

- Once you have completed the form, you can save your changes, download the form as a PDF, print it out for submission, or share it directly if needed.

Start filling out your PA DoR REV-1196 form online today to address your identity theft concerns.

The PA Department of Revenue may send you various communications, including tax forms, notices about tax liabilities, or information on refunds and credits. These documents are crucial for staying compliant with Pennsylvania tax laws. If you need help managing these communications, consider using platforms like uslegalforms to simplify the process related to PA DoR REV-1196.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.