Loading

Get Irs 941-pr 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941-PR online

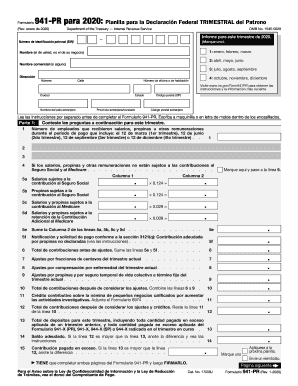

Filling out the IRS 941-PR form is an essential task for employers in the United States. This guide will walk you through the process of completing the form online, ensuring that you are equipped with the necessary information and instructions to do so successfully.

Follow the steps to complete the IRS 941-PR form online.

- Click ‘Get Form’ button to access the form and open it for editing.

- Fill in your employer identification number (EIN) at the top of the form. Ensure this number is accurate as it is crucial for your submission.

- In Part 1, provide the number of employees who received wages, tips, or other compensation during the reporting period.

- Complete lines 11 and 12 by entering any credits and then calculating your total contributions.

- Move on to Part 2, where you'll report your deposit schedule and the tax liability for the quarter.

- Finally, sign and date the form in Part 5, ensuring that you have completed both pages of the form 941-PR.

- Once you have filled out the form accurately, you can save any changes, download a copy for your records, print it out, or share it as necessary.

Start filing your IRS 941-PR online for efficient and accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To determine taxable Social Security wages for the IRS 941-PR, you should first identify the total wages subject to Social Security tax. This amount includes all earnings, tips, and other compensation before any deductions. Additionally, remember to exclude any non-taxable benefits, ensuring that your reported figures are accurate and compliant.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.